Whiting Petroleum Announces Bakken Midstream Divestiture

On November 21, 2016, Whiting Petroleum announced its intention to sell its Bakken midstream assets to an affiliate of Tesoro Logistics Rockies for $375 million.

Nov. 23 2016, Updated 4:12 p.m. ET

Whiting to sell Bakken assets

On November 21, 2016, Whiting Petroleum (WLL) announced its intention to sell its Bakken midstream assets to an affiliate of Tesoro Logistics Rockies, a subsidiary of Tesoro Logistics (TLLP), for $375 million. Tesoro Logistics is an MLP formed by Tesoro (TSO), an independent refiner.

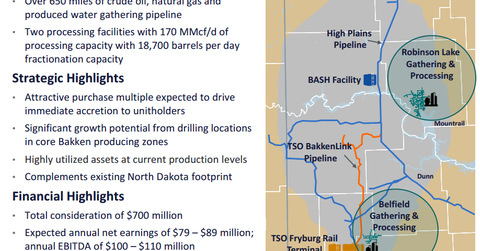

WLL will sell its 50% stake in the Robinson Lake natural gas–processing plant along with the associated natural gas–gathering system located in Mountrail County, North Dakota.

Transaction highlights

WLL will also sell its 50% stake in the Belfield natural gas–processing plant along with the associated natural gas–gathering, crude oil–gathering, and water-gathering systems located in Stark, Billings, and Dunn Counties, North Dakota.

A press release by WLL noted that from April 2016 to September 2016, these plants had an average daily throughput of 132 MMcfpd (million cubic feet per day).

WLL’s other partners in these midstream assets, GBK Investments and WBI Energy Midstream, also agreed to sell their shares in the assets to Tesoro.

The divested assets include gathering systems, including over 650 miles of crude oil, natural gas, and produced water–gathering pipeline. TLLP’s press release noted that the two natural gas–processing plants have 170 MMcf per day of processing capacity and a fractionation capacity of 19,000 barrels per day in the Sanish and Pronghorn fields in the Williston Basin.

Production from the Williston Basin accounts for a large segment of WLL’s total production. The Williston Basin is home to one of the biggest shale plays in the United States, the Bakken shale play. Continental Resources (CLR) and Hess Corporation (HES) are two of the key operators in the Bakken. Other operators include Newfield Exploration (NFX) and Oasis Petroleum (OAS). All these companies, including WLL, make up ~6% of the iShares U.S. Oil & Gas Exploration & Production ETF (IEO).

The transaction is expected to close in 1Q17.