Goldman Sachs Rated Cal-Maine Foods as ‘Neutral’

Cal-Maine Foods (CALM) reported fiscal 1Q17 net sales of $239.8 million, a fall of 60.7% compared to its net sales of $609.9 million in fiscal 1Q16.

Nov. 11 2016, Published 6:15 p.m. ET

Price movement

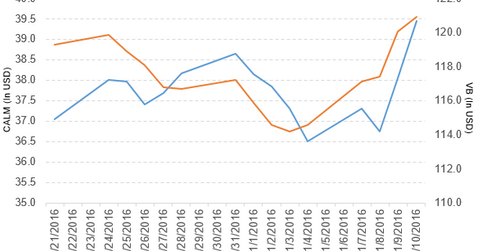

Cal-Maine Foods (CALM) has a market cap of $1.9 billion. It rose 3.7% to close at $39.45 per share on November 10, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 5.8%, 3.7%, and -12.8%, respectively, on the same day.

CALM is trading 4.7% above its 20-day moving average, 1.4% below its 50-day moving average, and 12.8% below its 200-day moving average.

Related ETFs and peers

The Vanguard Small-Cap ETF (VB) invests 0.04% of its holdings in Cal-Maine Foods. The ETF tracks the CRSP US Small Cap Index. The market cap–weighted index includes the bottom 2%–15% of the investable universe. The YTD price movement of VB was 10.4% on November 10.

The market caps of Cal-Maine Foods’s competitors are as follows:

Cal-Maine Foods’s rating

On November 10, 2016, Goldman Sachs (GS) initiated its coverage of Cal-Maine Foods with a “neutral” rating. It also set the stock’s price target at $37.00 per share.

Performance of Cal-Maine Foods in fiscal 1Q17

Cal-Maine Foods (CALM) reported fiscal 1Q17 net sales of $239.8 million, a fall of 60.7% compared to its net sales of $609.9 million in fiscal 1Q16. The price of a dozen eggs sold and produced fell 6.4% and 1.9%, respectively, in fiscal 1Q17, compared to fiscal 1Q16.

Its net income and EPS (earnings per share) fell to -$30.9 million and -$0.64, respectively, in fiscal 1Q17, compared to $143.0 million and $2.95, respectively, in fiscal 1Q16.

CALM’s cash and short-term investments and inventories fell 21.2% and 0.13%, respectively, in fiscal 1Q17 compared to 4Q16. Its current ratio rose to 7.6x in fiscal 1Q17, compared to 7.5x in fiscal 4Q16. It reported a debt-to-equity ratio of 0.21x in fiscal 1Q17 and fiscal 4Q16.

Next, we’ll discuss Constellation Brands (STZ).