Industrias Bachoco SAB de CV

Latest Industrias Bachoco SAB de CV News and Updates

Understanding Cal-Maine Foods’ Performance in Fiscal 2Q17

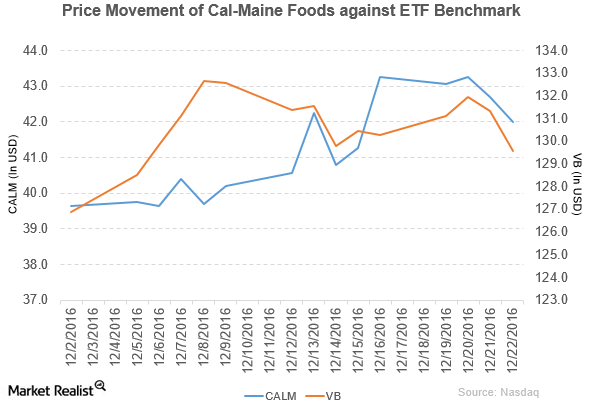

Cal-Maine Foods (CALM) has a market cap of $1.9 billion. It fell 1.6% to close at $42.00 per share on December 22, 2016.

Goldman Sachs Rated Cal-Maine Foods as ‘Neutral’

Cal-Maine Foods (CALM) reported fiscal 1Q17 net sales of $239.8 million, a fall of 60.7% compared to its net sales of $609.9 million in fiscal 1Q16.