US Refinery Demand Impacts Crude Oil Inventories

US refineries operated at 93.4% of their operable capacity in the week ending May 5, 2017. The rise in refinery demand is bullish for crude oil prices.

Nov. 20 2020, Updated 4:04 p.m. ET

US refinery demand

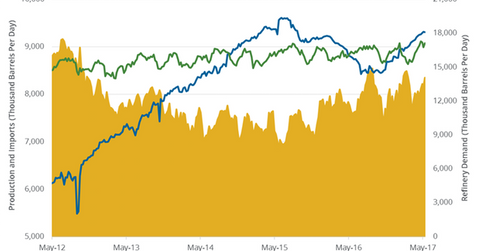

The EIA (U.S. Energy Information Administration) reported that US refinery crude oil demand rose by 363,000 bpd (barrels per day) to 17,122,000 bpd on May 5–12, 2017. US refinery crude oil demand rose 2.2% week-over-week and 4.6% YoY (year-over-year). US refinery demand hit 17,285,000 bpd for the week ending April 21, 2017—the highest level ever.

US refineries operated at 93.4% of their operable capacity in the week ending May 5, 2017. The rise in refinery demand is bullish for crude oil (BNO) (PXI) (UCO) prices. For more on crude oil prices, read Part 1 of this series. Higher crude oil prices have a positive impact on oil producers’ earnings like Apache (APA), Swift Energy (SFY), Chevron (CVX), and SM Energy (SM).

US crude oil imports

The EIA reported that US crude oil imports rose by 970,000 bpd to 8,590,000 bpd on May 5–12, 2017. Imports rose 12.7% week-over-week and 11.9% YoY.

US crude oil inventories

The rise in refinery demand and fall in US crude oil production on May 5–12, 2017, would have likely led to the fall in inventories. However, the rise in US crude oil imports for the same period could have limited the fall in inventories. A rise in exports could have also contributed to the fall in inventories. For more on US production, read the previous part of this series. For more on US crude oil inventories, read Part 2 of this series.

In the next part, we’ll take a look at US gasoline prices and how they impact crude oil prices.