Investors Are Worried about an Impending Squall

Inverse ETFs can help protect against a squall US stocks bumped up against all-time highs again this year. After hitting a new intraday high of 2,178 on August 1, the S&P 500 was unable to hold onto the gains. Sector performances offer a glimpse of where we are in the market cycle. The top performing […]

Sept. 8 2016, Published 12:16 p.m. ET

Inverse ETFs can help protect against a squall

US stocks bumped up against all-time highs again this year. After hitting a new intraday high of 2,178 on August 1, the S&P 500 was unable to hold onto the gains. Sector performances offer a glimpse of where we are in the market cycle. The top performing sectors over the past 12 months have been telecommunications, consumer staples, and utilities. While energy, materials, and financials have brought up the rear, even though their most recent rally.

What’s striking is that these performances fall in line with what you might expect to see during an economic contraction, with defensive sectors leading the market. Some already felt that this was a sign that the market is already preparing for recession.

The vote by the UK to leave the European Union is having enormous effects across global markets. Market reaction in the first two trading days after the vote reflects that there was almost no expectation of a Brexit and, thus it was not adequately priced into the market. As Prime Minister David Cameron announced that he will resign by this fall, the perceived flight to safety is in full swing, as global investors move to shelter capital in the face of uncertainty.

Market Realist

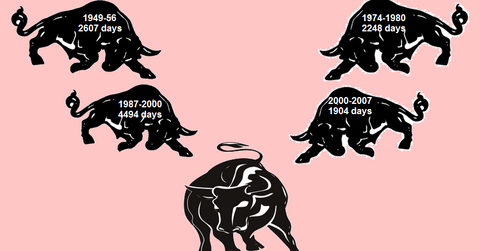

US equities (VOO) (SPY) have had a rather quiet summer. The current bull run is now in its seventh year, and in April 2016, it became the second-longest bull run in US history. With concerns arising from the UK’s vote to leave the EU, or Brexit, the global growth slowdown, a weak US jobs report, and rich valuations, it’s no wonder investors are getting antsy. And there are many reasons for the recent disquiet.

The length of the US bull market is meanwhile casting doubt on the odds of its longevity. Investors tend to believe that as a bull run gets longer, equities have lesser room to run.

Moreover, September is usually considered the bleakest month for stocks—and not without good reason, because it’s a well-documented seasonal trend. The graph above shows the total number of times the S&P 500 (IVV)(VTI) has been up or down each month from 1928 to 2015. The S&P 500 (SPDN) (SPXL) has been down 47 times in September and up only 39 times. This makes September the weakest month for equities.

Obviously, this factor does little to quell the worries of an impending squall. The possibility of a rate hike by the US Federal Reserve is also causing anxieties among investors. Equities tend to flourish in looser monetary policy conditions. As the Fed prepares to tighten its gears, investors are starting to feel the heat.

Continue to the next part of this series for a discussion of other factors causing anxiety among investors.