Direxion Daily S&P 500® Bear 1X ETF

Latest Direxion Daily S&P 500® Bear 1X ETF News and Updates

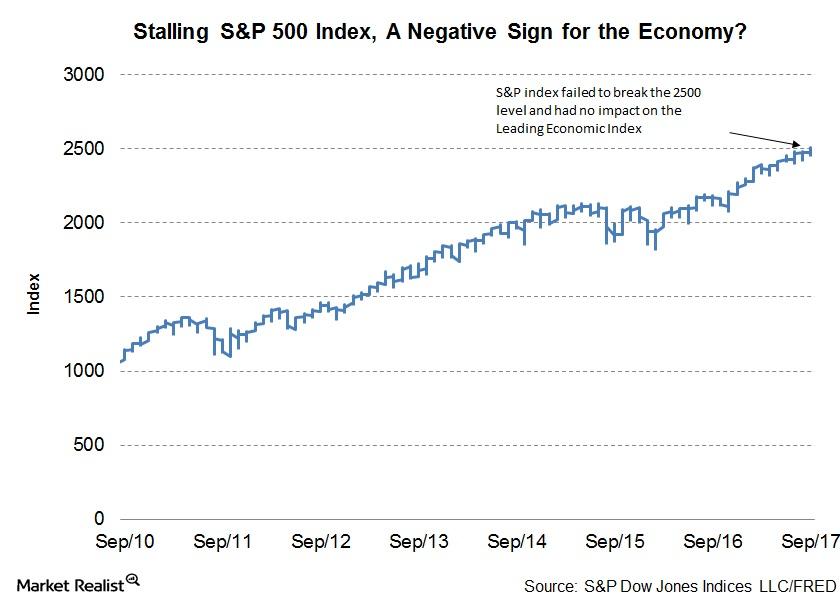

The Link between the S&P 500 and the Leading Economic Index

The S&P 500 is stuck The S&P 500 (IVV) index has been stuck near the 2,500 level for more than a month now. The recent war of words between US president Donald Trump and North Korean foreign minister Ri Yong Ho has increased risk aversion. However, the index has been resilient despite the rise in volatility. […]

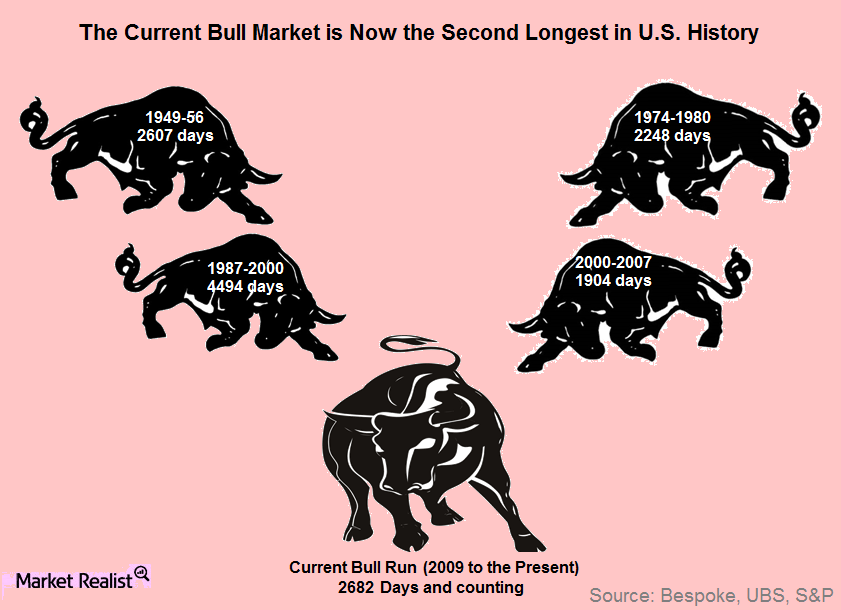

Investors Are Worried about an Impending Squall

Inverse ETFs can help protect against a squall US stocks bumped up against all-time highs again this year. After hitting a new intraday high of 2,178 on August 1, the S&P 500 was unable to hold onto the gains. Sector performances offer a glimpse of where we are in the market cycle. The top performing […]

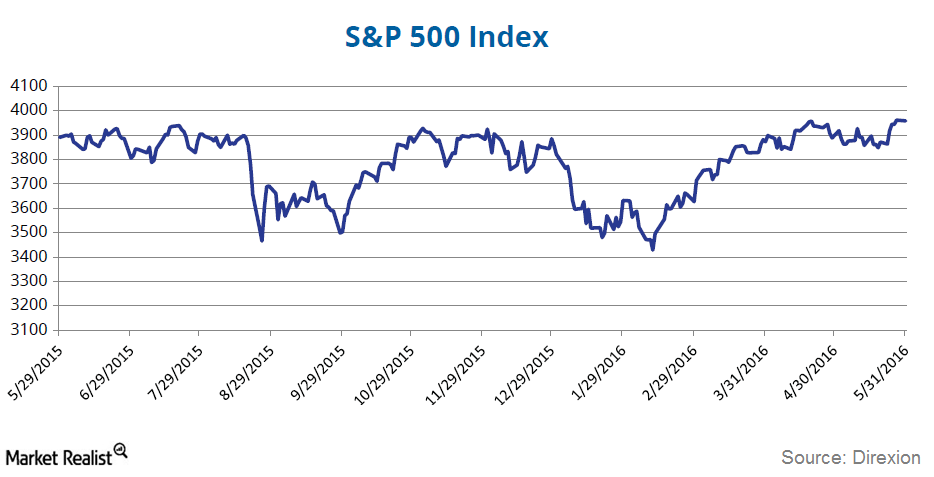

Where Is the Market Headed: Double Bottom? Triple Top?

Double bottom? From a technical standpoint, the current environment may have been viewed as either bullish or bearish. Those on the bull side of the equation took heart in a technical indicator known as the double bottom. The double bottom reversal is a bullish reversal pattern that traders use to anticipate possible upside movements. As its […]