What’s on the Energy Calendar for Oil and Gas Traders This Week?

The US energy sector contributed to ~6.3% of the S&P 500 (SPY) (SPX-INDEX) on May 12, 2017.

Nov. 20 2020, Updated 11:22 a.m. ET

Important events on the energy calendar

The US energy sector contributed to ~6.3% of the S&P 500 (SPY) (SPX-INDEX) on May 12, 2017. Crude oil and natural gas are major parts of the energy sector. The earnings of oil and gas producers like Noble Energy (NBL), ExxonMobil (XOM), Sanchez Energy (SN), and Goodrich Petroleum (GDP) depend on crude oil (ERY) (ERX) (FXN) and natural gas (UNG) (UGAZ) prices. For the latest updates on crude oil prices, read part one and part four of this series.

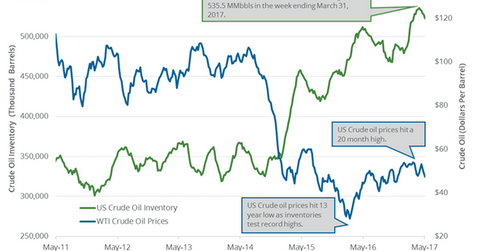

Oil and gas prices are driven by catalysts such as inventories and supply and demand data. Let’s take a look at some important events for the energy sector this week.

Tuesday, May 16:

- The API (American Petroleum Institute) will release its crude oil inventory report.

Wednesday, May 17:

- The EIA (U.S. Energy Information Administration) will release its Weekly Petroleum Status report. Read US Crude Oil Inventories Post Biggest Draw since December for more information on the latest report.

- The EIA will release its “This Week in Petroleum” report.

Thursday, May 18:

- The EIA will release its Weekly Natural Gas Storage report. Read Lower Rise in US Natural Gas Inventories Boosted Prices for more information on the latest report.

- The EIA will provide its Natural Gas Weekly Update report.

Friday, May 19:

- Baker Hughes will release the US crude oil rig count.

- Baker Hughes will release the US natural gas rig count.

In the next part, we’ll take a look at the crude oil market’s highs and lows in the last 15 months.