Why Did Natural Gas Prices Fall to 2-Month Lows?

Natural gas futures contracts for September delivery fell by 0.4% and settled at $2.55 per MMBtu on August 11. Natural gas prices tested two-month lows.

Aug. 12 2016, Published 12:49 p.m. ET

Natural gas prices

Natural gas futures contracts for September delivery fell by 0.4% and settled at $2.55 per MMBtu (million British thermal units) on August 11, 2016. Prices tested two-month lows due to a larger-than-expected rise in natural gas inventories and mild summer weather.

The United States Natural Gas ETF (UNG) follows US natural gas futures. It fell by 1.0% to $7.60 on August 11, 2016.

Weather outlook

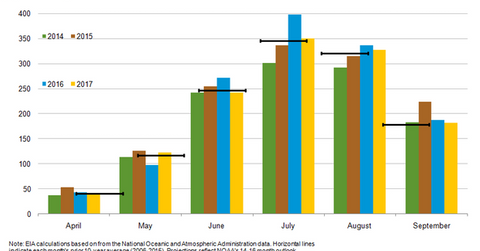

Updated weather models suggest that temperatures will be warmer than normal from August 11–17, 2016, in the southern and central parts of the US. However, cooler temperatures should be experienced in the plains and possibly the northeastern parts of the US during the last week of August 2016.

Around 50% of US households use natural gas for heating and cooling. Hot summer weather drives the demand for natural gas–fired electricity generation to power air conditioning. The rise in demand impacts inventories. We’ll learn more about US natural gas inventories in Part 3 of this series.

The U.S. Energy Information Administration reported that temperatures in the Lower 48 states averaged 80 degrees for the week ending July 28, 2016—the highest so far in 2016. Temperatures in the Lower 48 states averaged 78 degrees for the week ending August 4, 2016.

For the week ending August 4, 2016, temperatures were one degree higher than the same period in 2015. This is three degrees higher than the normal temperatures for this period of the year.

The summer season will end in about three weeks. Changes in the weather have a short-term impact on natural gas prices.

Impact on stocks and ETFs

Uncertainty in natural gas prices impacts natural gas producers’ earnings such as Rex Energy (REXX) and Antero Resources (AR).

It also impacts funds such as the Direxion Daily Natural Gas Related Bull 3x Shares ETF (GASL) and the First Trust ISE-Revere Natural Gas ETF (FCG).

Series focus

In this series, we’ll cover natural gas prices’ peaks and lows in 2016, natural gas inventories, the natural gas rig count, production, consumption, the US Commodity Futures Trading Commission’s “Commitment of Traders” report, and some price forecasts for natural gas.

In the next part, we’ll discuss US natural gas prices in the early morning trade on August 12, 2016.