How Do Freeport McMoRan’s Fundamentals Compare to Its Peers?

Freeport-McMoRan (FCX) has been trading largely sideways around the $12 price level for almost a month. August has been a dull month for most companies in the metals and mining space.

Aug. 22 2016, Published 4:45 p.m. ET

Freeport’s technicals and fundamentals

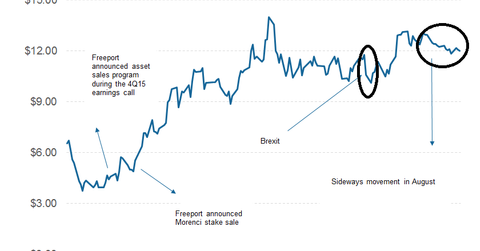

Freeport-McMoRan (FCX) has been trading largely sideways around the $12 price level for almost a month. August has been a dull month for most companies in the metals and mining space.

Southern Copper (SCCO) and Teck Resources (TCK) are trading almost flat this month while Turquoise Hill Resources (TRQ) has lost ~12% in August. However, BHP Billiton (BHP), which reported its fiscal 2016 earnings on August 16, has gained ~6% in August.

Bulls versus bears

The bulls (UPRO) and bears (SPXS) have been involved in a battle of sorts to wrest control over Freeport-McMoRan. The year started on a weak note and commodity companies fell to multiyear lows in January. However, the bulls have taken over since then, and we saw decent upward price action between February and April.

Although the bears took charge in May, miners recouped their losses shortly thereafter. Even the Brexit vote turned out to have only a short-term subduing effect on sentiments.

ETF alternatives

You can also consider the Materials Select Sector SPDR ETF (XLB) to get diversified exposure to the materials sector. Metal producers currently form ~13.1% of XLB’s portfolio.

Alternatively, investors who want direct exposure to copper can also consider the PowerShares DB Base Metals ETF (DBB). DBB invests one-third of its holdings in copper.

Series overview

In this series, we’ll do a fundamental and technical analysis of Freeport-McMoRan (FCX). We’ll compare FCX with some of the other major copper producers.

We’ll also see what are analysts projecting for Freeport-McMoRan and other miners this month. This should help us understand whether the recent consolidation is an opportunity for investors.

In the next part of this series, we’ll look at Freeport-McMoRan’s short interest.