ProShares UltraPro S&P500

Latest ProShares UltraPro S&P500 News and Updates

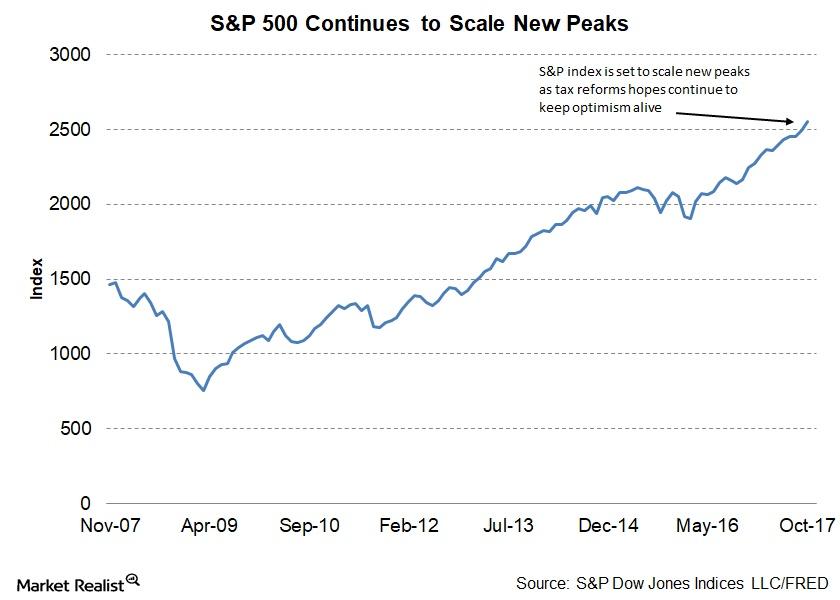

Why the S&P 500 Index Is Considered a Leading Indicator

The S&P 500 Index has risen 2.2% in October and is en route to its eighth straight positive monthly close.

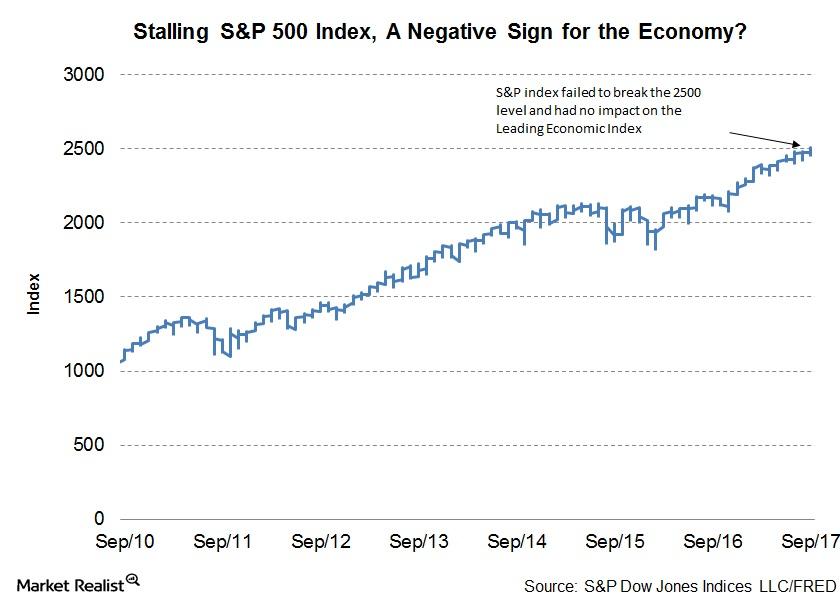

The Link between the S&P 500 and the Leading Economic Index

The S&P 500 is stuck The S&P 500 (IVV) index has been stuck near the 2,500 level for more than a month now. The recent war of words between US president Donald Trump and North Korean foreign minister Ri Yong Ho has increased risk aversion. However, the index has been resilient despite the rise in volatility. […]

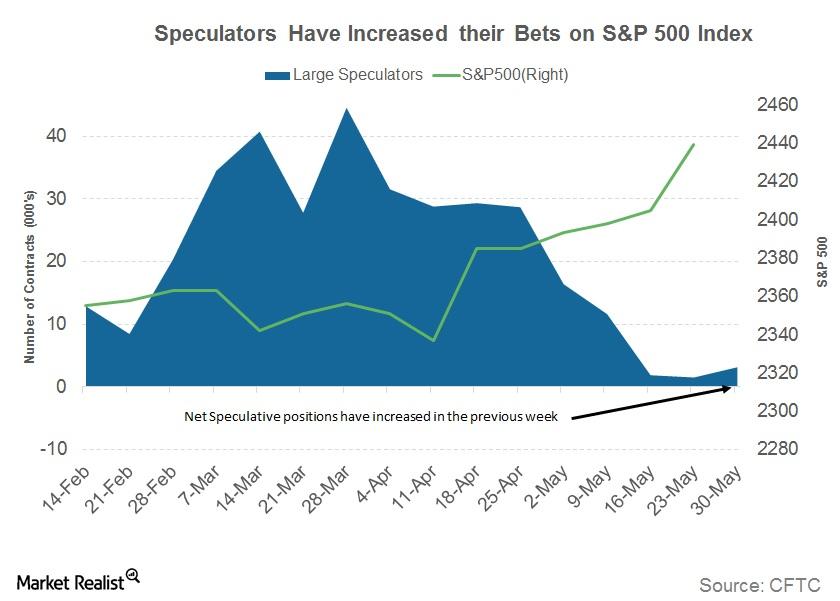

Can the S&P 500 Index Keep Rallying amid Slow Job Growth?

SPY recorded yet another lifetime high of 2,440.04 on Friday, June 2, gaining 0.96% for the week and continuing its 1.43% gain from the previous week.

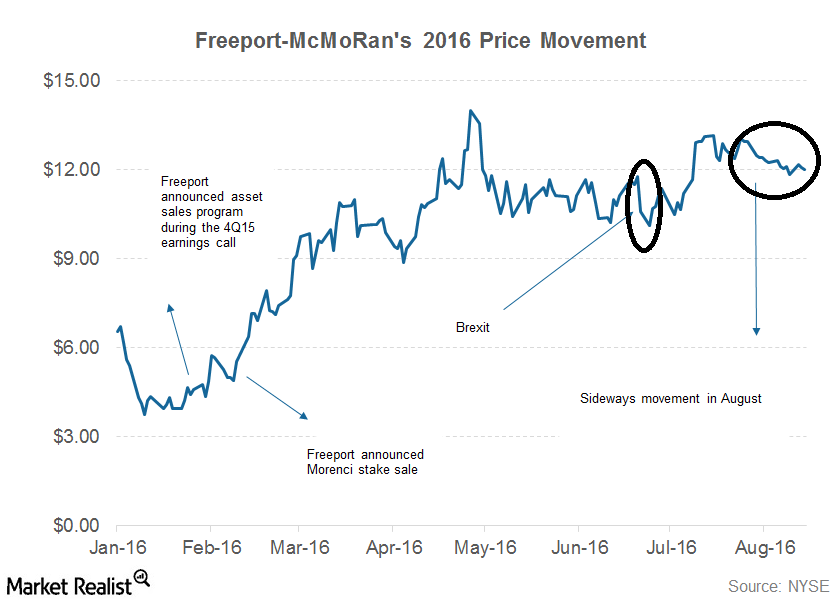

How Do Freeport McMoRan’s Fundamentals Compare to Its Peers?

Freeport-McMoRan (FCX) has been trading largely sideways around the $12 price level for almost a month. August has been a dull month for most companies in the metals and mining space.