Direxion Daily S&P500® Bear 3X ETF

Latest Direxion Daily S&P500® Bear 3X ETF News and Updates

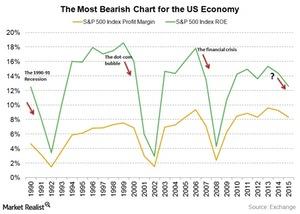

Why the S&P 500 Net Profit Margin May Predict a US Recession

Over a good four decades, the S&P 500’s net profit margin has fallen notably when the economy was on the verge of, or already into, a recession.

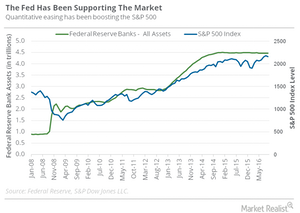

Jeffrey Gundlach: The Fed Has Been Supporting the S&P 500

Gundlach also believes it’s interesting to look at the correlation between the size of the Fed’s balance sheet and the S&P 500 (SPY) (SPXS) (SPXL) level.

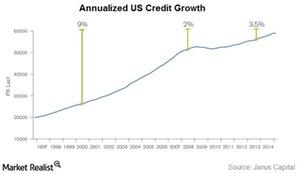

Bill Gross: Credit Is the Oil That Lubes the System

Currently, we’re in a highly levered system, especially the developed world. A levered economy depends on continued credit creation for stability and growth.

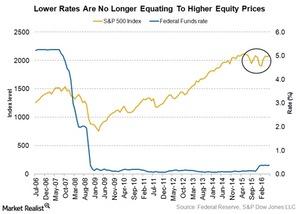

Lower Rates Aren’t Equating to Higher Equity Prices

Bill Gross provided his view on lower rates no longer resulting in credit creation in the economy. They have also lost their efficacy in raising equity prices.

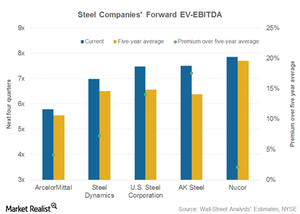

A Comparative Analysis of Steel Companies’ Relative Valuations

In this article, we’ll look at steel companies’ forward EV-to-EBITDA multiples to see if there are some underpriced or overpriced bets in the sector.