A Look at BHP Billiton’s Balance Sheet after Fiscal 2016

BHP has a strong balance sheet in this depressed commodity environment. Standard & Poor’s cut its rating by one notch from A+ to A in February 2016.

Aug. 22 2016, Updated 11:04 a.m. ET

Balance sheet strength

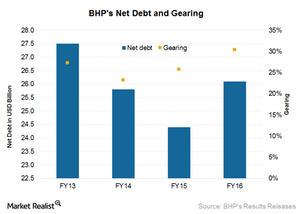

BHP Billiton’s (BHP) (BBL) net debt was $26.1 billion as of June 30, 2016. That’s slightly higher than $25.9 billion as of December 31, 2015. Rio Tinto’s (RIO) pro forma net debt, on the other hand, declined by $900 million to $12.9 billion at the end of June 2016 compared to December 2015.

In this part of the series, we’ll look at BHP’s leverage and the strength of its balance sheet.

Financial leverage

- BHP has a strong balance sheet in this depressed commodity environment. Standard & Poor’s cut its rating by one notch from A+ to A in February 2016 to reflect lower commodity prices on a negative outlook. It had warned of another rating cut after BHP’s results. But given the capex (capital expenditure) and dividend cuts announced by BHP, that might not be necessary.

- BHP’s credit rating is strong compared to its peer group, including Freeport-McMoRan (FCX), Vale SA (VALE), and Anglo American (AAUKY).

- Its leverage, or net debt to net debt plus equity, is 30.3%. Rio Tinto has a lower leverage of ~23%.

- BHP’s maturity profile is well balanced with low refinancing risks. With liquidity of $16 billion, its short-term business needs are well covered.

- The company has lowered its dividends and capex to protect its balance sheet in this environment of depressed commodity prices.

BHP expects its net debt to decline from its current level in fiscal 2017.

The iShares MSCI Global Metals & Mining Producers ETF (PICK) provides diversified exposure to the metals and mining sector. Rio Tinto’s listings form 11.5% of PICK’s holdings. The SPDR S&P Metals and Mining ETF (XME) also invests in some of these stocks.

In the next part of this series, we’ll look at BHP’s ability to generate free cash flow.