Regeneron’s Robust Pipeline

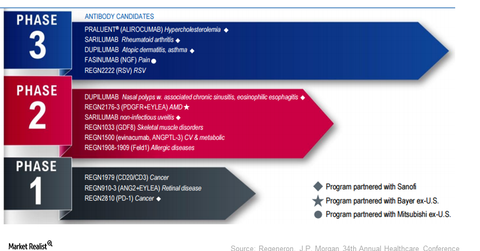

Regeneron’s (REGN) robust pipeline consists of 13 molecules in various phases of development. Sarilumab is under review with the FDA.

July 12 2016, Updated 9:06 p.m. ET

Regeneron’s pipeline

Regeneron’s (REGN) robust pipeline consists of 13 molecules in various phases of development. Its four late-stage pipeline molecules include the following:

- sarilumab for rheumatoid arthritis

- dupilumab for atopic dermatitis

- fasinumab for pain associated with osteoarthritis and low back

- REGN2222 for the prevention of respiratory syncytial virus F (or RSV-F)

Sarilumab

Sarilumab, a human IL-6 receptor antibody, is being evaluated in association with Sanofi (SNY). The molecule is under review with the FDA (U.S. Food and Drug Administration) for the indication of rheumatoid arthritis (or RA).

The company filed a BLA (Biologics License Application) for the drug in November 2015 and has been assigned a PDUFA (Prescription Drug User Fee Act) date of October 30, 2016.

According to the recent top-line results of SARIL-RA-MONARCH, a Phase 3 monotherapy study, sarilumab proved to hold stronger efficacy in active RA patients than AbbVie’s (ABBV) Humira, one of the lead biologics for RA. However, this outcome isn’t part of the ongoing FDA review.

The RA market is quite competitive with leading drugs such as Amgen’s (AMGN) Enbrel, Johnson & Johnson’s (JNJ) Remicade, and Roche’s (RHHBY) Actemra. Enbrel, Humira, and Remicade are TNF (tumor necrosis factor) inhibitors, while Actemra is an IL-6 inhibitor.

With better efficacy, sarilumab might experience an advantage over TNF class drugs.

If you want to have exposure to growing Regeneron but avoid excessive company-specific risks, you can invest in ETFs. ETFs offer diversified exposure to various equities across multiple sectors. One such ETF is the Health Care Select Sector SPDR ETF (XLV), which offers a 1.0% weight in Regeneron.

Next, let’s look at dupilumab, another Regeneron late-stage pipeline molecule.