How Might Yields React to a Dot-Com Bubble Situation?

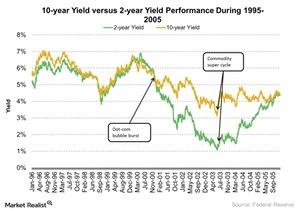

During the 1999–2002 dot-com bubble crisis, the US 2-Year Treasury yield fell by 74%. It made a high of 6.9% in May 2000 and a low of 1.8% in September 2002.

July 20 2016, Published 11:13 a.m. ET

10-Year and 2-Year yields

Investors around the globe generally prefer safe-haven assets such as gold (GLD), government bonds (BND), and fixed-income securities (AGG) (TLT) when there are uncertainties in the world (VEU) (VTI). As the demand for government bonds rises during a major crisis, bond prices soar, and yields, which move opposite to bond prices, fall.

During the 1999–2002 dot-com bubble crisis, the US 2-Year Treasury yield fell by 74%. The yield made a high of 6.9% in May 2000 and a low of 1.8% in September 2002.

The US 10-Year Treasury yield fell by 41% during the same period. The yield made a high of 6.5% in May 2000 and a low of 3.8% in September 2002. The fall in the yields indicated that the demand for government debt rose during the period.

Overvaluation of Internet stocks triggered the dot-com crisis

The major event in the mid-1990s was the Internet (or dot-com) bubble. The financial markets in industrialized nations saw their equity values rise quickly due to growth in the Internet sector, which helped to rapidly increase stock prices. Internet businesses experienced exponential growth.

The collapse of this bubble took place between 1999 and 2001. The crisis was triggered by the overvaluation of Internet stocks. Now we’ll analyze how the yield curve reacted when the commodity cycle supported the rally in the S&P 500 Index (SPY) (QQQ).

Yield curve during the bull run

When the equity market started to recover during the commodity super cycle, yields started rising. The rally in commodity prices and the demand from emerging markets were the major drivers of the 2003-2007 bull run. EPS (earnings per share) growth also showed a strong performance during the period.

As equity markets and corporate earnings picked up, money flowed into the equity market. The demand for fixed-income securities fell a bit, resulting in improving yields.

In the next part, we’ll analyze how the equity market reacted during the dot-com bubble crisis.