Otezla Captures Psoriasis and Psoriatic Arthritis Market Shares

Celgene (CELG) expects Otezla to earn revenue of up to $1 billion in 2016 and in the range of $1.5 billion–$2 billion in 2017.

May 14 2016, Updated 9:08 a.m. ET

Otezla’s market share

Celgene (CELG) expects Otezla to earn revenue of up to $1 billion in 2016 and in the range of $1.5 billion–$2 billion in 2017. The company has adopted an aggressive pricing strategy to increase Otezla’s prescriptions and market share.

Otezla was launched at a 30% discount to the average price of biologic drugs. It’s currently priced 35% lower than its competitor drugs. Celgene plans to continue with this pricing strategy to dominate the I&I (immunology and inflammation) space in 2016.

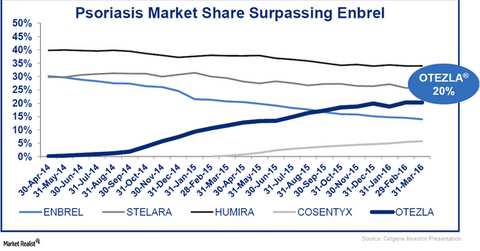

In the United States, Otezla has managed to be a leader in the new-to-brand segment. It accounts for a 42% share in the psoriasis segment.

The drug also holds a ~20% share in the overall psoriasis market, which is higher than that of Amgen’s (AMGN) Enbrel and Johnson & Johnson’s (JNJ) Stelara (through its subsidiary Janssen Biotech) but lower than that of AbbVie’s (ABBV) Humira and Novartis’ Cosentyx.

Otezla also holds a 38% share of the new-to-brand PsA (psoriatic arthritis) market and a 15% share of the overall PsA market in the United States. Otezla’s share of the PsA market is higher than those of other drugs such as Enbrel, Stelara, Cimzia, and Remicade.

Geographic growth

In addition to the US market, Celgene is also focused on negotiating reimbursement decisions in other early launch countries in Europe. Expansion into European markets is expected to be a key growth driver for Otezla after 2017.

Celgene has also filed applications with a regulatory body in Japan to approve Otezla for both psoriasis and PsA. To know more about Otezla’s geographic market expansion, you can read How Will Celgene Grow Otezla’s Revenues in 2016?

If Celgene manages to realize its market strategy for Otezla, its share price could jump, along with the share price of the Health Care Select Sector SPDR ETF (XLV). Celgene makes up about 3.0% of XLV’s total portfolio holdings.

In the next article, we’ll explore Celgene’s research programs in the immunology and inflammation space.