Januvia and Janumet: Merck’s Blockbuster Diabetes Drugs

Januvia and Janumet are Merck & Co.’s (MRK) blockbuster diabetes drugs. They’re are used to lower blood sugar levels in patients with Type 2 diabetes.

May 12 2016, Updated 10:09 a.m. ET

Januvia and Janumet

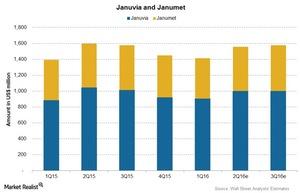

Januvia and Janumet are Merck & Co.’s (MRK) blockbuster diabetes drugs. They’re used to lower blood sugar levels in patients with Type 2 diabetes. Combined sales for these drugs totaled ~$1.4 billion in 1Q16, a 4% growth at constant exchange rates, offset by a 3% negative impact of foreign exchange. This resulted in a 1.4% growth in revenues for these drugs in 1Q16 over 1Q15.

What makes Januvia and Janumet top sellers?

Januvia and its combination version Janumet are drugs classified as DPP-4 (dipeptidyl peptidase-4) inhibitors. DPP-4 is an enzyme that removes incretin from the human body for people without Type 2 diabetes. People with Type 2 diabetes use DPP-4 inhibitors to lower their blood sugar levels. DPP-4 inhibitors sometimes prevent weight gain in Type 2 diabetes patients.

Competitors for Januvia and its combination version Janumet are Onglyza, jointly manufactured by Bristol-Myers Squibb (BMY) and AstraZeneca (AZN), and Galvus by Novartis (NVS). Recently, Januvia was confirmed for a high safety profile and no risk of major adverse cardiovascular events or hospitalization for heart failure by the American Diabetes Association. There were a few concerns in the safety profile for Onglyza, according to an FDA (U.S. Food and Drug Administration) report.

Merck has also received marketing authorization for Marizev in Japan. Marizev is a once-weekly DPP-4 inhibitor.

Contribution of Januvia and Janumet

Januvia and Janumet together contributed about 15.2% of Merck’s total revenues for 1Q16, a ~0.4% increase over 1Q15 in terms of contribution. These drugs are estimated to contribute ~15.9% of total revenues for 2Q16, and 15.7% of total revenues for 3Q16, reflecting a positive trend.

For US markets, Januvia holds a 75% market share. Revenues increased 9% due to increased demand and the buying pattern of a few customers. Outside the US markets, Januvia holds a 65% market share. Reported growth in Europe and Japan was partially offset by lower sales in emerging markets and Venezuela. Revenues increased 5% outside the US markets, excluding Venezuela.

To avoid risk, investors can consider ETFs such as the SPDR S&P Pharmaceuticals ETF (XPH), which holds ~4.6% of its total assets in Merck.