4 Ways an Economy Can Deleverage: Ray Dalio Explains

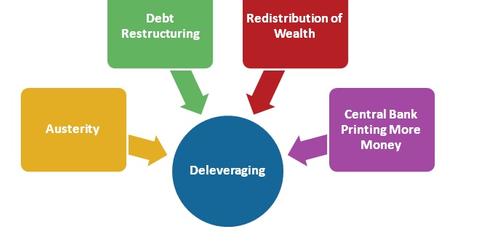

In his “Economic Principles at Work” template, Ray Dalio identifies four ways any world (ACWI)(VTI)(VEU) economy can deleverage. Find out why this matters.

April 26 2016, Updated 7:06 p.m. ET

Dalio talks about deleveraging

In his “Economic Principles at Work” template, Ray Dalio identifies four ways any world (ACWI)(VTI)(VEU) economy can deleverage.

1. Austerity

This refers to a cut in spending. However, this practice usually worsens the situation and leads to depression.

2. Debt restructuring

Since banks don’t want their assets to disappear (in the case of a default), they agree to restructure the debt (BND)(AGG)—lower debt, a longer period, or a lower rate. However, in this case too, income and spending fall faster, leading to deflation.

3. Redistribution of wealth

The government may take fiscal policy measures to redistribute wealth. However, this practice leads to the government’s fiscal budget exploding as its spends more on unemployment claims and monetary stimulus than it earns in taxes, since lower income means lower taxes. The only remaining option is to raise taxes on the rich to redistribute wealth. This method is also deflationary.

4. Central bank printing money

While the first three are deflationary, this is an inflationary measure of deleveraging. In 2008, the US Federal Reserve took this step when it printed over $2 trillion. Under this method, the central bank prints money and invests in financial assets. It buys government bonds while also pumping that money into the economy through social benefits and stimulus programs, in effect decreasing unemployment and increasing consumer spending.

Sometimes central banks use two or more methods to deleverage. In this case, together, the central bank and the government need to balance deflationary pressures with inflationary pressures (printing new money).

When printing money doesn’t lead to inflation

You have to remember that printing money doesn’t lead to inflation as long as it offsets the fall in credit. Since credit has disappeared, the additional money just makes up for it initially, so prices don’t rise. The central bank then needs to print enough money to get income growing faster than debt.

This is where the concept of “helicopter money” comes into the picture. Learn more in the next part of this series.