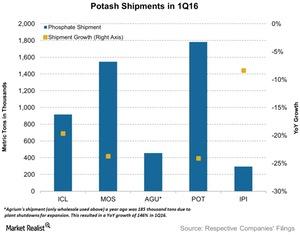

How Potash Shipments Performed in 1Q16

Mosaic (MOS) and PotashCorp (POT) were hit the hardest, with their respective shipments declining by 24% each to 1.5 million tons and 1.7 million tons year-over-year.

Nov. 20 2020, Updated 5:27 p.m. ET

Potash producers

Potassium chloride (or KCl), also known as MOP (muriate of potash), is the most widely used potash fertilizer around the globe.

PotashCorp (POT), Mosaic (MOS), Israel Chemicals (ICL), and Agrium (AGU) are some of the largest producers of potassium fertilizers listed on the US stock exchanges.

Potash shipments decline

Mosaic (MOS) and PotashCorp (POT) were hit the hardest, with their respective shipments declining by 24% each to 1.5 million tons and 1.7 million tons year-over-year. Israel Chemicals (ICL) experienced a 20% decline in shipments with 0.9 million tons during the same quarter.

Intrepid Potash (IPI), which primarily produces potash fertilizer, had the softest impact, with shipments declining only by 8% to 0.29 million tons.

All companies listed in the chart above experienced a decline in potash shipments during the quarter ended March 2016 except for Agrium. The company underwent a plant shutdown last year, which positively impacted its shipments.

Will things get better?

The potash segment has been facing challenges following the bumper crop season a few years ago. However, PotashCorp’s management anticipates an improvement in 2016 and is expecting shipments to be higher than in 2015.

The company expects this on the back of improvement in affordability of fertilizers as well as a better outlook on the Indian monsoon season. You can read more about the Indian monsoon forecast in Will the Indian Monsoon Forecast Lift Fertilizer Companies?

You may access some of the above companies through the SPDR S&P North American Natural Resource ETF (NANR), which invests about 13% of its portfolio in the agricultural chemicals sector.

Next, let’s look at potash prices.