Who Were the Top MLP Losers Last Week?

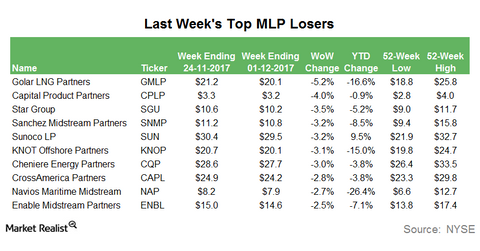

Four of the top MLP losers last week were marine transportation MLPs, including GMLP, CPLP, KNOP, and NAP.

Nov. 20 2020, Updated 4:47 p.m. ET

Golar LNG Partners

Marine transportation MLPs (master limited partnerships) were weak last week (ended December 1, 2017). Four of the top MLP losers last week were marine transportation MLPs, including Golar LNG Partners (GMLP), Capital Product Partners (CPLP), KNOT Offshore Partners (KNOP), and Navios Maritime Midstream Partners (NAP).

Golar LNG Partners was the top MLP loser last week, falling 5.2%. CPLP, KNOP, and NAP lost 4.0%, 3.1%, and 2.7%, respectively. GMLP’s fall last week can be mostly attributed to its weak 3Q17 earnings. GMLP reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $80.5 million for 3Q17, which represents a 16.8% YoY (year-over-year) fall.

Star Group

Star Group (SGU) (formerly Star Gas Partners), which is an LDC (local distribution company) involved mainly in the sale of home heating products to residential and commercial customers, was the third-biggest MLP loser last week, ending the week 3.5% lower. The partnership has lost 5.2% YTD (year-to-date).

Sanchez Midstream Partners

Sanchez Midstream Partners (SNMP), a midstream MLP mainly involved in natural gas gathering and processing, was the fourth-biggest MLP loser last week, falling 3.2% during the week. It has lost 8.5% YTD.

Sunoco LP

Sunoco LP (SUN), the MLP subsidiary of Energy Transfer Equity (ETE) involved primarily in wholesale distribution and marketing of refined products, was the fifth-biggest MLP loser last week. SUN saw a new six-month low of $28.4 last week. It recovered slightly during later half of the week, ending the week 3.2% lower.

However, SUN is still trading in positive territory in 2017, having risen 9.5% YTD, and is still among the top YTD MLP gainers. For details, read the series Why These Ten MLPs Are Up When the Sector Is Down.

Other top MLP losers

Cheniere Energy Partners (CQP), CrossAmerica Partners (CAPL), and Enable Midstream Partners (ENBL) were among the top ten MLPs losers last week, showing WoW (week-over-week) declines of 3.0%, 2.8%, and 2.5%, respectively.

In the next part, we’ll look into Enbridge Energy Partners’ technical indicators.