Sunoco LP

Latest Sunoco LP News and Updates

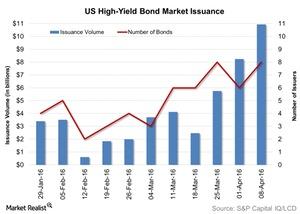

High Yield Bond Issuance Hit 2016 Record Last Week

High yield bond issuance surged last week and hit its highest level in 2016 yet due to continued growth in volume.

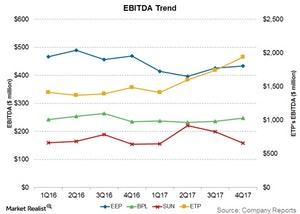

Why Energy Transfer Partners’ Earnings Are on the Rise

Energy Transfer Partners (ETP) reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $1.9 billion in 4Q17.