Cheniere Energy Partners LP

Latest Cheniere Energy Partners LP News and Updates

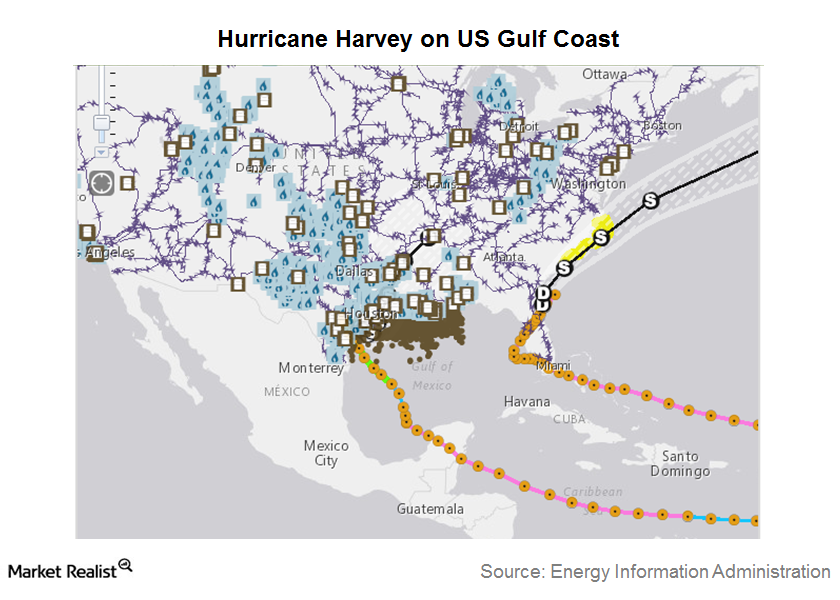

Hurricane Harvey Impacted Energy MLPs

Hurricane Harvey hit the US Gulf Coast last week. The US Gulf Coast is a major destination for US refineries and energy infrastructure.

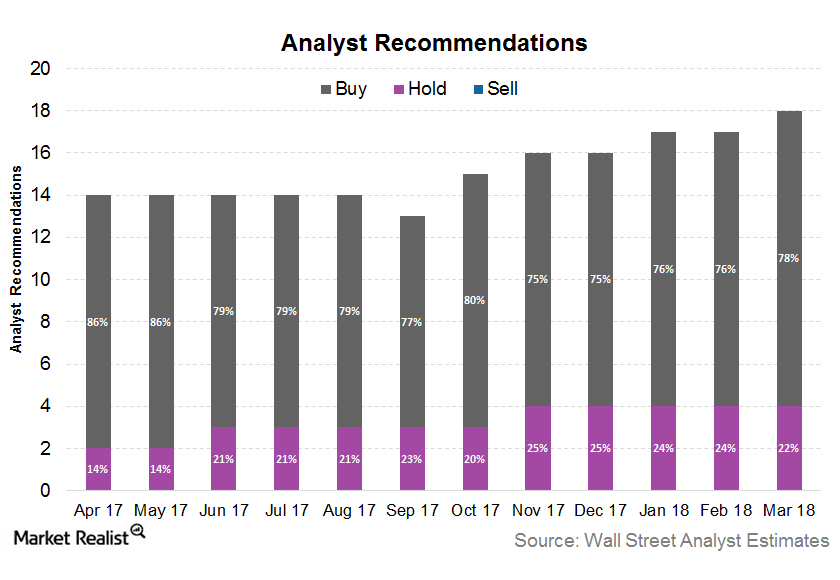

Cheniere Energy: What Analysts Recommend

Currently, 78% of the analysts surveyed by Reuters rate Cheniere Energy as a “buy” as of March 22, 2018, while the remaining 22% rate it as a “hold.”

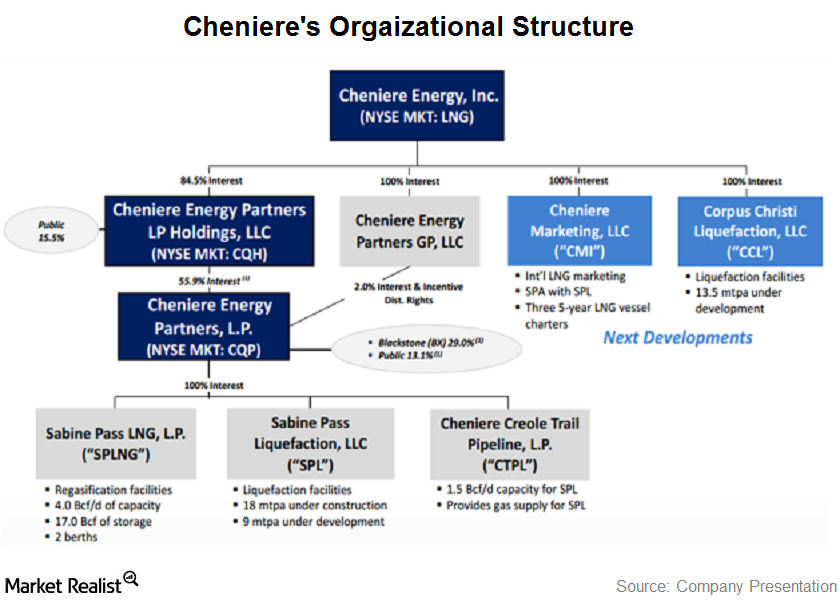

A must-know overview of Cheniere Energy

Cheniere Energy, Inc., is a Houston-based energy company engaged in the liquefied natural gas business.The Sabine Pass liquefaction project is one of the first projects to receive the necessary government permits to export liquefied natural gas.

These Midstream Players Have Created Maximum Wealth for Investors

In this series, we’ll look at the historical outliers in midstream energy, which have generated massive wealth amid turbulent times.

Natural Gas Prices: What to Expect in 2019

The EIA expects US natural gas prices to average $2.89 per MMBtu in 2019. For 2020, the forecast is $2.92 per MMBtu.

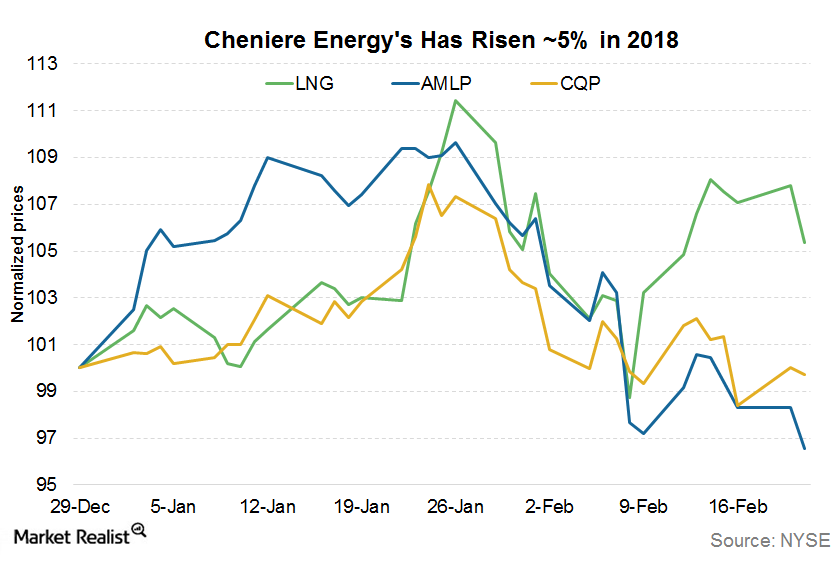

Cheniere Energy Stock after Its 4Q17 Earnings

Cheniere Energy is trading 4.4% above its 50-day simple moving average and 18.0% above its 200-day simple moving average.

How the Recent Trafigura Deal Could Boost Cheniere Energy’s Stock

Cheniere Energy’s subsidiary, Cheniere Marketing, recently entered into a long-term SPA (sale and purchase agreement) with Trafigura.

What’s Driving Cheniere Energy’s Recent Rally?

Cheniere Energy (LNG) has risen 9.7% in the last six trading sessions. It rose 12.1% in December 2017 alone.

Cheniere Energy to Buy Remaining Stake in CQH for ~$1 Billion

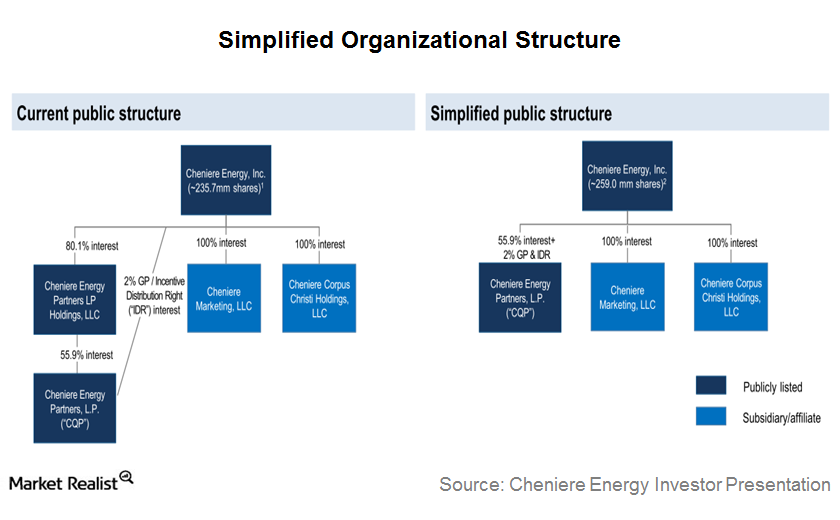

Cheniere Energy (LNG) is looking to simplify its organizational structure by acquiring its remaining stake in Cheniere Energy Partners LP Holdings (CQH).

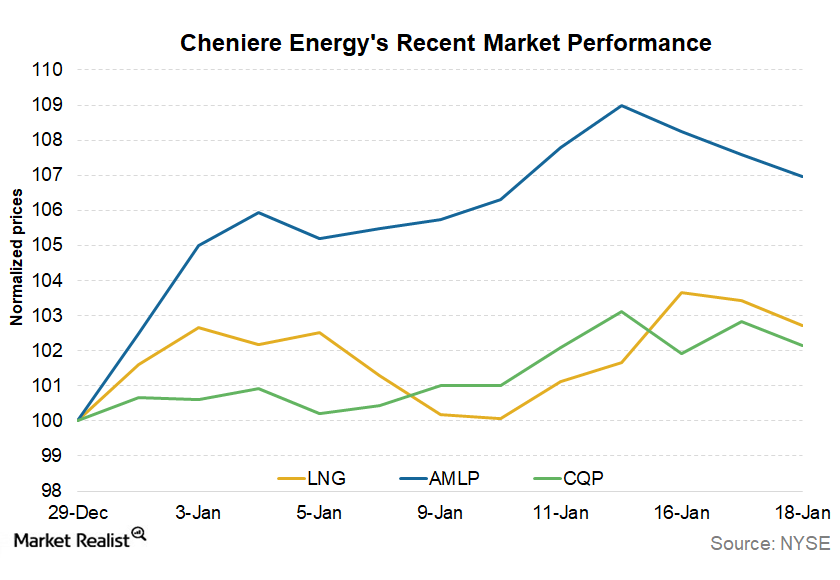

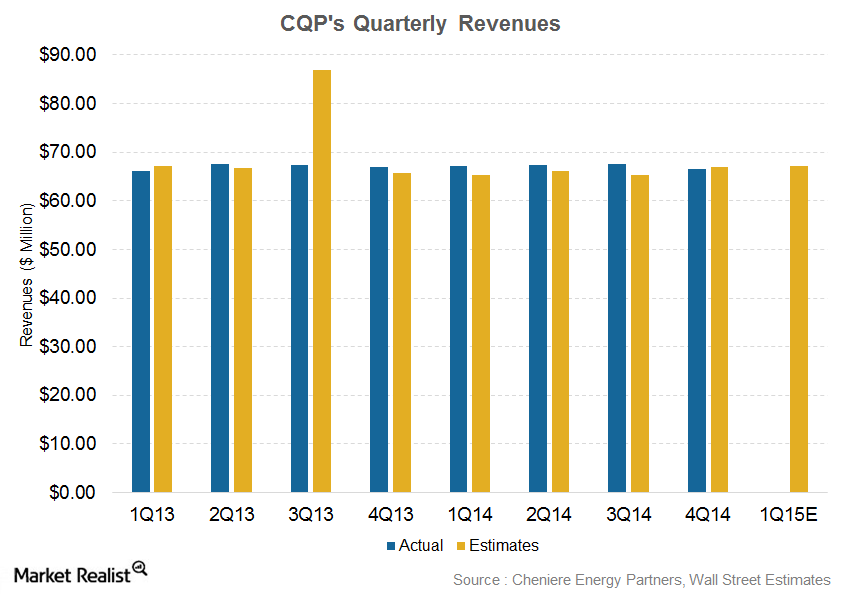

Analyzing Cheniere Energy Partners’ Historical Performance

For 1Q15, analysts are expecting Cheniere Energy Partners’ revenue to come in at $67.1 million. The loss per share estimates have been pegged at -$0.113.