Why Did Heating Oil and Diesel Fuel Prices Rise?

US on-highway diesel fuel prices rose by 2% and were at $2.02 per on March 7, 2016. The current diesel prices are 46% lower than they were a year ago.

March 14 2016, Updated 9:06 a.m. ET

Heating oil prices

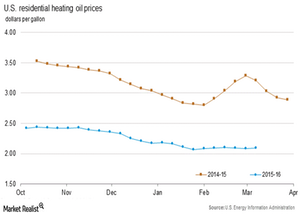

The EIA (U.S. Energy Information Administration) reported that US residential heating oil prices rose by $0.01 per gallon to $2.1 per gallon on March 7, 2016—compared to February 29. In contrast, heating oil prices fell by 34.7% in the past year for the same period. The mild winter in 2015–2016 compared to 2014–2015 led to the massive decline in heating oil prices. A mild winter limits the heating needs during the heating season.

Diesel fuel prices

US on-highway diesel fuel prices rose by 2% and were at $2.02 per on March 7, 2016—compared to February 29. The current diesel prices are 46% lower than they were a year ago. Diesel prices fell due to mild weather in 2015–2016 compared to 2014–2015. This led to lower heating demand. The fall in individual spending on diesel-based transport also contributed to the fall in diesel prices. Heating oil and diesel fuel are distillate components. Distillate stocks are the key drivers of heating oil and diesel fuel prices.

Heating oil and diesel fuel price forecast for 2016

The EIA forecasts that heating oil prices could average around $1.98 per gallon in 2016 and $2.17 per gallon in 2017, respectively. It estimates that diesel fuel prices could average around $2.12 per gallon and $2.32 per gallon in 2016 and 2017, respectively. High heating oil and diesel oil prices benefit US refiners like Western Refining (WNR), Tesoro (TSO), Valero Energy (VLO), Holly Frontier (HFC), and Marathon Petroleum (MPC). In contrast, low crude oil prices impact oil and gas producers’ margins like Synergy Resources (SYRG), WPX Energy (WPX), and Hess (HES).