US Crude Oil Production: Bearish Driver for Oil Prices

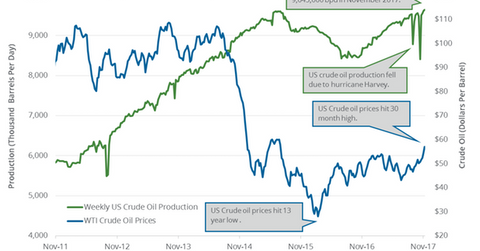

The EIA estimates that US crude oil production rose by 25,000 bpd (barrels per day) or 0.3% to 9,645,000 bpd on November 3–10, 2017.

Nov. 16 2017, Updated 10:25 a.m. ET

US crude oil production

The EIA estimates that US crude oil production rose by 25,000 bpd (barrels per day) or 0.3% to 9,645,000 bpd on November 3–10, 2017. Production is at the highest level since 1983, which weighed on crude oil (USO) (UCO) prices on November 15, 2017. US crude oil (UWT) (DWT) prices fell 3% in the last five trading session due to record US crude oil production and forecasts of a rise in US shale oil production for the 12th straight month.

Why US crude oil production hit a record

US crude oil production tested 8,428,000 in July 2016, which was the lowest level since June 2014. Production has risen ~14.4% or by 1,217,000 bpd since its low in mid-2016. Production has risen mainly due to the rise in crude oil prices, technological advancement, and improving production and break-even costs for US shale producers compared to peers.

US crude oil prices are near a multiyear high. Energy producers (PXI) (FXN) (XLE) like Anadarko Petroleum (APC), Sanchez Energy (SN), Goodrich Petroleum (GDP), and Marathon Oil (MRO) benefit from higher crude oil prices.

US crude oil production estimates

Goldman Sachs predicts that US crude oil production will rise by 850,000 bpd in 2018 if crude oil prices trade around $55 per barrel during the same period. Morgan Stanley estimates that 18 US oil and gas producers reported that production could be 1% higher in 2017 compared to 2016.

The EIA estimates that US production will average 9,230,000 bpd and 9,950,000 bpd in 2017 and 2018, respectively. Production averaged 9.4 MMbpd and 8.9 MMbpd in 2015 and 2016, respectively.

Impact

US crude oil production’s annual average was at 9,637,000 bpd in 1970. If US production hit a new record in 2018, it would offset some of the impacts from ongoing production cuts. It would also weigh on crude oil (BNO) (DWT) prices. So, US oil production is considered the biggest bearish driver of oil prices.

In the next part, we’ll discuss US gasoline inventories.