Pipeline Segment Will Drive NuStar Energy’s 4Q15 Performance

The pipeline segment is NuStar’s largest business segment in terms of the EBITDA. It accounted for 50% of the total segment EBITDA in the first nine months of 2015.

Dec. 4 2020, Updated 10:53 a.m. ET

NuStar Energy’s pipeline segment

The pipeline segment is NuStar Energy’s (NS) largest business segment in terms of the EBITDA (earnings before interest, tax, depreciation, and amortization). The segment accounted for 50% of the company’s total segment EBITDA in the first nine months of 2015. NuStar’s pipeline segment mainly provides crude oil, refined products, distillate, and NGL (natural gas liquid) transportation services. Crude oil accounted for 47% of the pipeline receipts in the last 12-month period ending September 30, 2015.

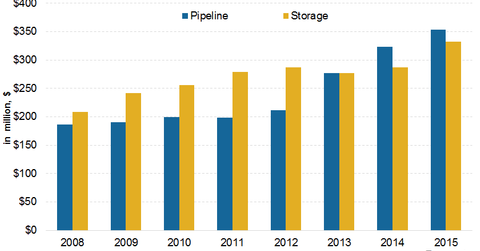

The above graph shows the contribution of NuStar’s pipeline and storage segment. NuStar Energy expects the pipeline segment’s 2015 EBITDA to be $25–$35 million higher than 2014. This is less than NuStar’s prior guidance for the segment. The fall in the pipeline segment’s EBITDA guidance is due to lower throughput volumes along NuStar’s crude oil pipeline system. The lower throughput volumes are driven by the decline in the Eagle Ford’s production. The Eagle Ford’s total throughputs are expected to fall by 11.5% to 239 MMbpd (million barrels per day) in 4Q15 compared to 270 MMbpd in 4Q14.

NuStar Energy’s storage segment

NuStar Energy’s storage segment provides crude oil and refined products terminaling and storage services. Together, the pipeline and storage segment account for 98% of NuStar’s total segment EBITDA. The segment’s 2015 EBITDA is expected to be $40–$50 million higher than 2014. It will be driven by the Linden terminal acquisition, storage renewals, and insurance proceeds related to the Linden terminal.

NuStar Energy’s fuel marketing segment

The fuel marketing segment’s performance was negatively impacted by lower margins in the current low price environment. The segment mainly provides crude oil and refined product acquisition and marketing services.

Genesis Energy (GEL), Sunoco Logistics (SXL), and NGL Energy Partners (NGL) also saw a similar fall in their crude oil and refined products acquisition and marketing businesses. NuStar forms 3.3% of the Global X MLP ETF (MLPA). The partnership expects the fuel marketing segment’s 2015 EBITDA to be $10–$20 million.