NuStar Energy, L.P.

Latest NuStar Energy, L.P. News and Updates

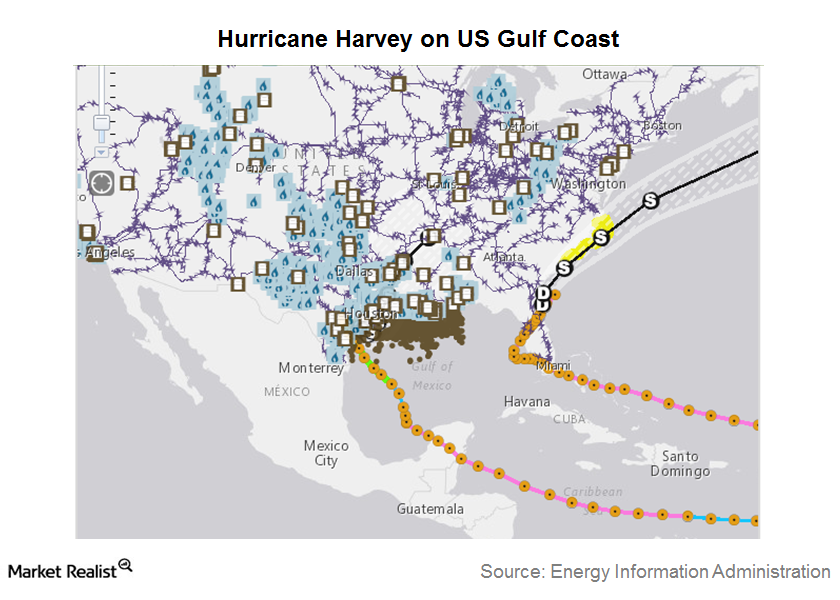

Hurricane Harvey Impacted Energy MLPs

Hurricane Harvey hit the US Gulf Coast last week. The US Gulf Coast is a major destination for US refineries and energy infrastructure.

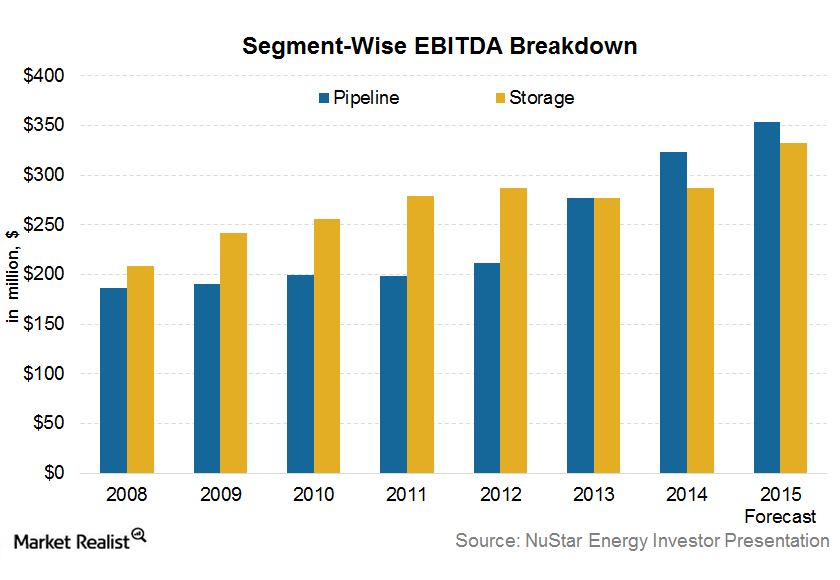

Pipeline Segment Will Drive NuStar Energy’s 4Q15 Performance

The pipeline segment is NuStar’s largest business segment in terms of the EBITDA. It accounted for 50% of the total segment EBITDA in the first nine months of 2015.

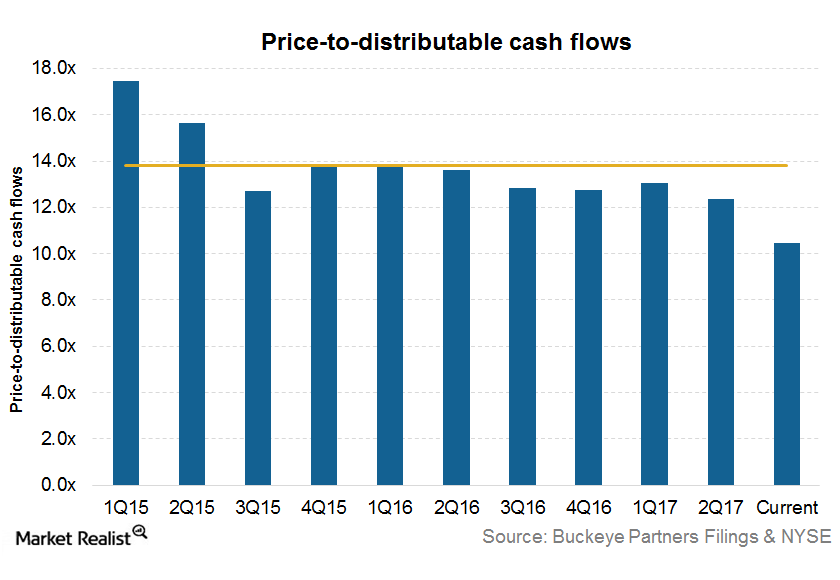

What Buckeye Partners’ Current Valuation Indicates

On October 31, 2017, Buckeye Partners (BPL) was trading at a price-to-distributable-cash-flow multiple of 10.4x, which is significantly below the historical ten-quarter average of 13.8x.

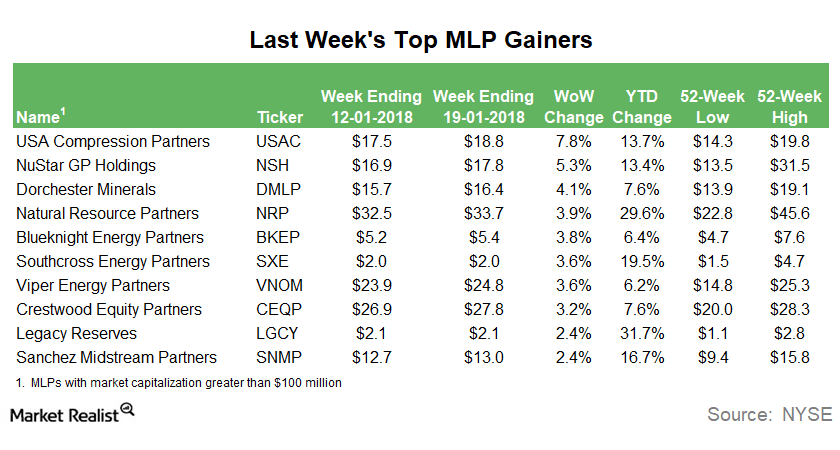

Why USAC Was the Top MLP Last Week

USA Compression Partners (USAC), a midstream MLP involved in natural gas contract compression services, was the top MLP gainer last week with WoW (week-over-week) gains of 7.8%.

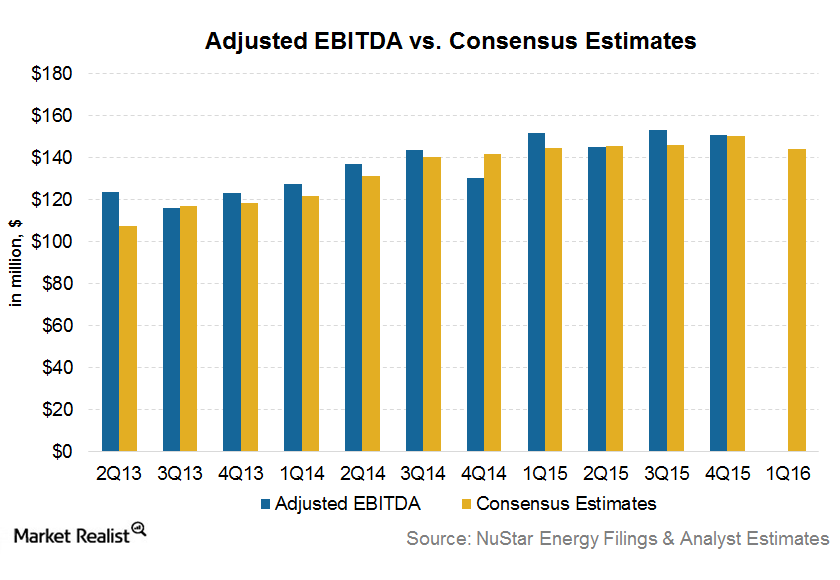

Analyzing NuStar Energy’s 1Q16 EBITDA Estimates

NuStar Energy is expected to release its 1Q16 earnings on April 27. Wall Street analysts’ 1Q16 consensus EBITDA estimate for NuStar Energy is $144.3 million.

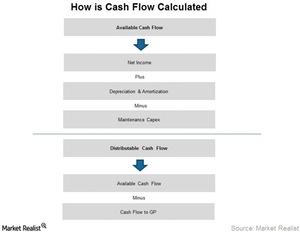

The Importance of the Distribution Coverage Ratio

The distribution coverage ratio is the most important ratio for MLPs, as it highlights the cash available to the LP unit holders divided by the cash distributed to LP unit holders.