NGL Energy Partners LP

Latest NGL Energy Partners LP News and Updates

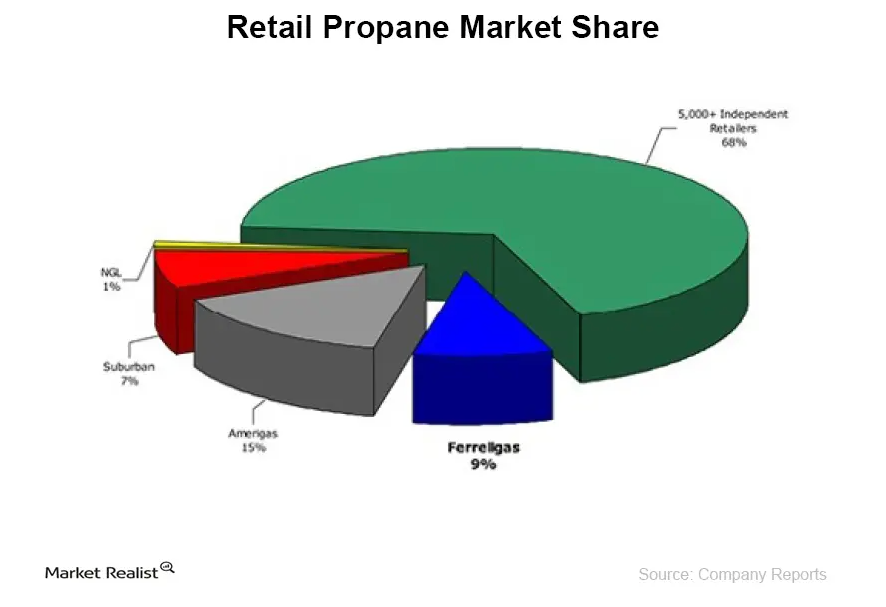

Must-know: How does AmeriGas stack up against its competition?

APU competes with Suburban Propane (SPH) and Ferrellgas Partners (FGP). APU is the country’s largest retail propane marketer, serving 2 million customers in all 50 states.

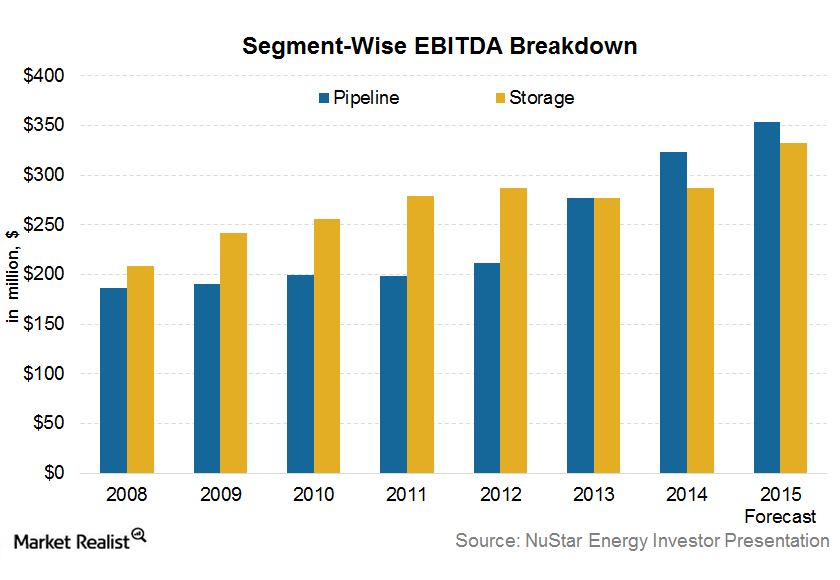

Pipeline Segment Will Drive NuStar Energy’s 4Q15 Performance

The pipeline segment is NuStar’s largest business segment in terms of the EBITDA. It accounted for 50% of the total segment EBITDA in the first nine months of 2015.

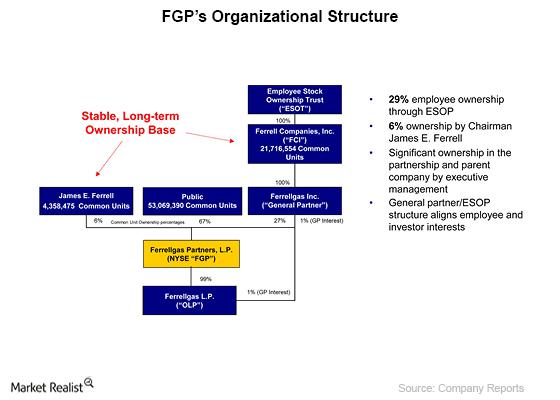

Ferrellgas Partners (FGP): An investor’s must-know overview

Ferrellgas Partners, L.P. (FGP), a master limited partnership (MLP), is the second largest retail propane distributor in the U.S. serving all 50 states, the District of Columbia and Puerto Rico, as measured by the volume of retail sales in fiscal 2013, and the largest national provider of propane by portable tank exchange.

Capital World Investors Sold a Major Position in NBL in Q2

So far in this series, we’ve looked at institutional investments in five major oil-weighted E&P (exploration and production) stocks: ConocoPhillips (COP), EOG Resources (EOG), Occidental Petroleum (OXY), Anadarko Petroleum (APC), and Pioneer Natural Resources (PXD).

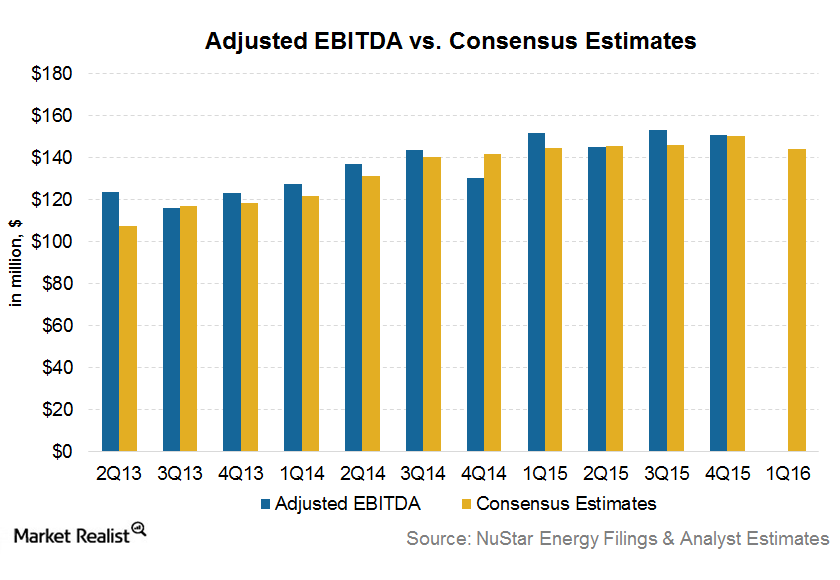

Analyzing NuStar Energy’s 1Q16 EBITDA Estimates

NuStar Energy is expected to release its 1Q16 earnings on April 27. Wall Street analysts’ 1Q16 consensus EBITDA estimate for NuStar Energy is $144.3 million.

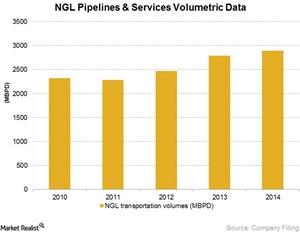

EPD’s Most Profitable Segment: NGL Pipelines & Services

EPD’s Natural Gas Liquid Pipelines & Services segment involves natural gas processing plants and NGL marketing activities.