Crude Oil Demand Expected to Grow from Road Transportation

OPEC has estimated that the road transportation sector will account for one-third of the global crude oil demand growth between 2014 and 2040.

Jan. 4 2016, Published 10:28 a.m. ET

Crude oil demand growth from road transportation sector

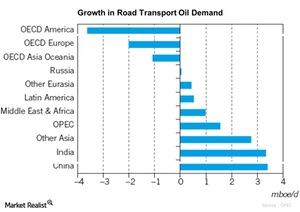

OPEC (Organization of the Petroleum Exporting Countries) has estimated that the road transportation sector will account for one-third of the global crude oil demand growth between 2014 and 2040. The petrochemicals and aeronautics divisions together account for another one-third. The remaining growth comes predominantly from the marine bunkers, agricultural, residential, commercial, and other industry segments.

Crude oil demand will decline in OECD region

OPEC has estimated that crude oil demand growth in the OECD (Organization for Economic Co-operation and Development) regions will decline by 2040 in every sector except aviation and petrochemicals. In developing countries, demand growth is expected in every sector except power generation.

From 2014–2040, OPEC expects crude oil demand growth in the road transportation sector to increase by 12.6 MMbpd (million barrels per day). In contrast, the OECD regions’ demand will fall by 6.7 MMbpd due to energy efficiency. A downtrend in crude oil usage per vehicle is expected in both developing countries and OECD regions.

The rise in crude oil demand in developing countries was derived from the increase in passenger cars by 1 billion. That number is just 125 million in the OECD region. Similarly, 229 million commercial vehicles will be added in developing countries and just 47 million in the OECD region.

The impact

The decline in crude oil demand results in lower sales volumes for crude oil producers. The decrease in sales volumes will decrease revenues of crude oil producers, which will affect the profitability of crude oil producers such as Apache (APA), Conoco Phillips (COP), Continental Resources (CLR), Devon Energy (DVN), and EOG Resources (EOG).

EOG Resources accounts for 4.2% of the Energy Select Sector SPDR ETF (XLE).