Demand and Supply Outlook for Potash in 2017

According to PotashCorp, the outlook for potash appears positive in 2017. North America, Latin America (especially Brazil), India, and China have been running low on inventory.

Feb. 28 2017, Updated 12:35 p.m. ET

Demand outlook

According to PotashCorp (POT), the outlook for potash appears positive in 2017. North America, Latin America (especially Brazil), India, and China have been running low on inventory, presenting a base for demand uptick in the coming months.

In Indonesia and Malaysia, favorable weather and prices for crops such as palm oil created a bright opportunity for potash demand, according to PotashCorp.

2017 estimates

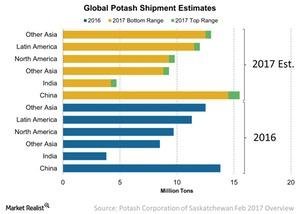

In total, the company expects global potash demand to come in the range of 61 million–64 million tons in 2017, compared to 59.6 million tons in 2016. Much of this growth in demand is estimated to come out of India, China, and other Asian regions, according to PotashCorp.

An uptick in demand also creates a favorable environment for an uptick in potash prices, which drives the margin and earnings growths of fertilizer companies (SOIL) (COMP-INDEX).

While demand is expected to rise, what conclusion can we come to about supply when the industry continues to have excess capacity?

Demand to outpace supply growth

In the chart above, we can see that global demand is expected to outpace net supply in 2017. This outperformance comes on the back of companies such as PotashCorp, The Mosaic Company (MOS), Intrepid Potash (IPI), and Agrium (AGU) adjusting their operating rates or idling their high-cost production mines.

According to PotashCorp, in 2016, the average operating rate was 91.5%. While demand’s outpacing supply is a highly favorable condition, potash producers have yet another card up their sleeves. We’ll look at it next.