Global X Fertilizers/Potash ETF

Latest Global X Fertilizers/Potash ETF News and Updates

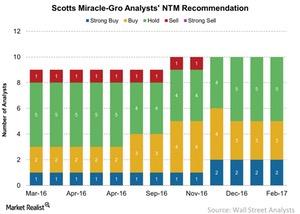

Scotts Miracle-Gro: Analyst Recommendations and Target Prices

Analyst recommendations for Scotts Miracle-Gro (SMG) have trended with earnings estimates, with more analysts recommending a “buy” for the stock.

Who Are the Biggest Players in the Fertilizer Industry?

There’s a handful of big players in the agricultural fertilizer industry. Setting up business requires huge capital, which makes for a high barrier to entry.

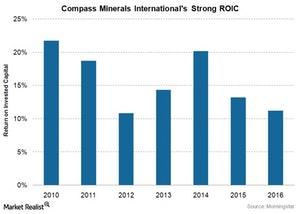

What’s Compass Minerals Doing to Gain a Cost Advantage?

Led by its superior assets, location, and geological advantages, Compass Minerals holds a competitive position with a wide economic moat rating.

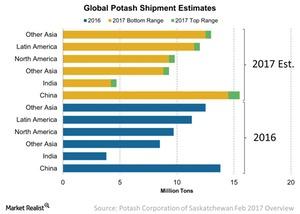

Demand and Supply Outlook for Potash in 2017

According to PotashCorp, the outlook for potash appears positive in 2017. North America, Latin America (especially Brazil), India, and China have been running low on inventory.

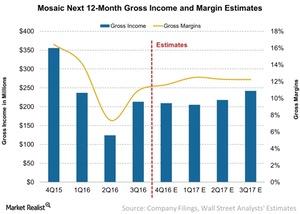

What Do Analysts Expect for Mosaic’s 4Q16 Gross Margin?

Wall Street analysts estimate that Mosaic (MOS) could report gross income of $209 million, which represents a 41% year-over-year fall from $355 million in 4Q15.

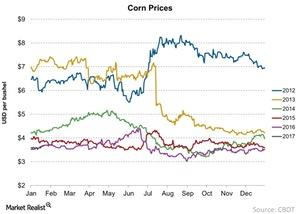

Why Corn Prices Moved Higher in January

Global corn prices are significantly lower than they’ve been for the past four years, considering the high global corn stock-to-use ratio last year.

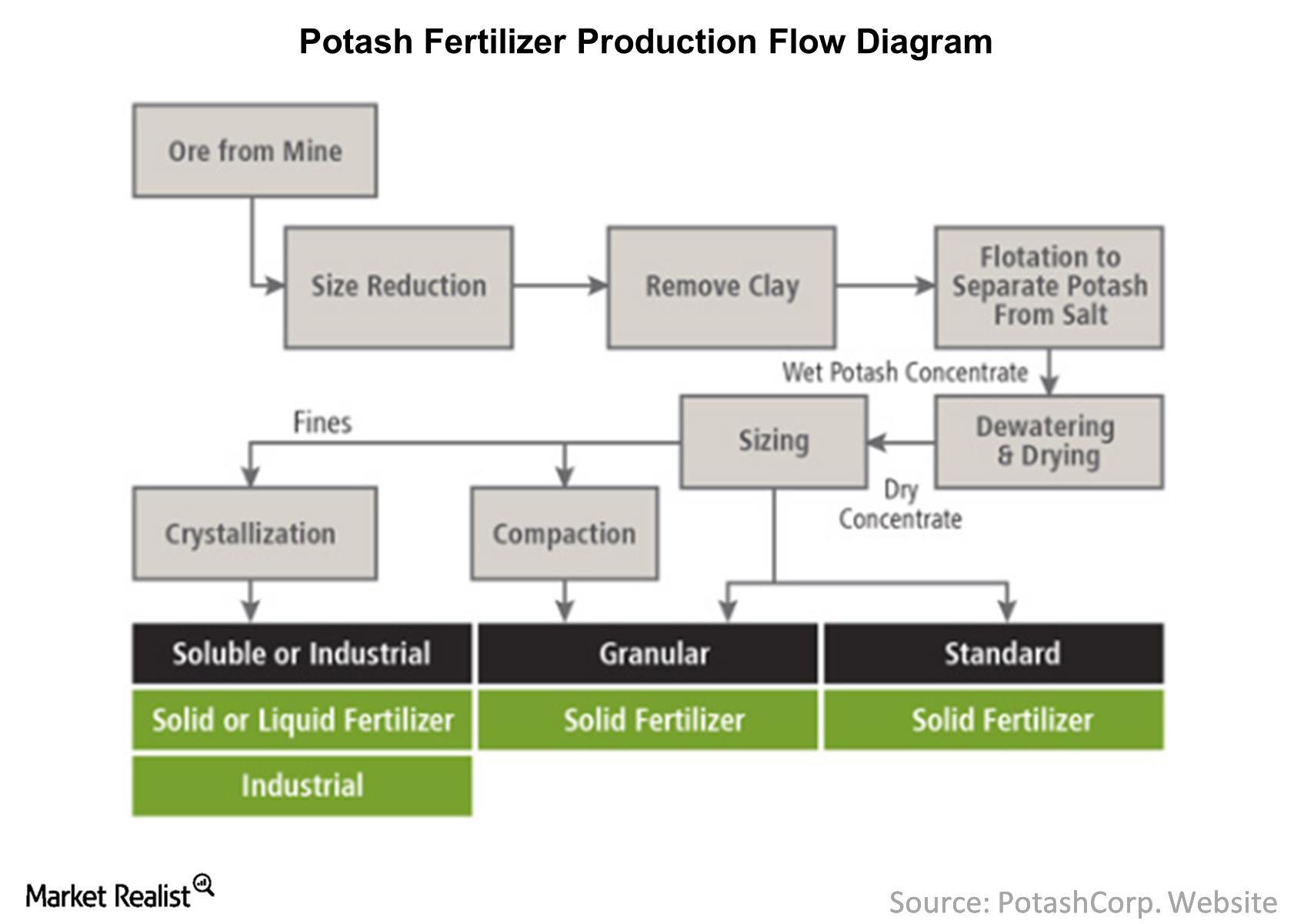

Potash Fertilizer Cost Drivers and Production Flow

Potash salts are the key cost of production for potash, so most producers have an integrated production.

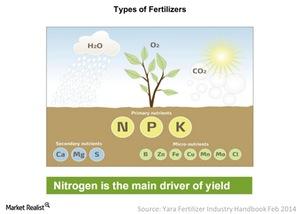

Breaking Down Types of Key Fertilizers Used Today

There’s a constant need to bring up the fertility levels necessary to grow crops, and that need is fulfilled by fertilizers.

Scotts Miracle-Gro’s Century-Old History

The history The Scotts Miracle-Gro Company (SMG) dates back to 1868. Conceived by Orlando McLean Scott, it aimed to give farmers weed-free and clean fields. In 1907, Scott’s son, Dwight, saw an opportunity in lawns playing a role in the American lifestyle. Therefore, the company started selling grass seeds, which replaced lower quality grass starters […]

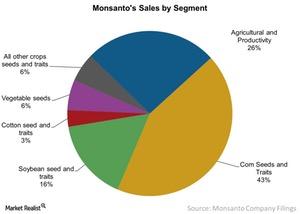

This Segment Has Become Important for Monsanto in the Last Decade

Monsanto (MON) conducts its global sales through two broad segments known as the Seeds & Genomics and Agricultural Productivity segments.