Under Armour Projects a ~26% Revenue Growth Rate for 2015

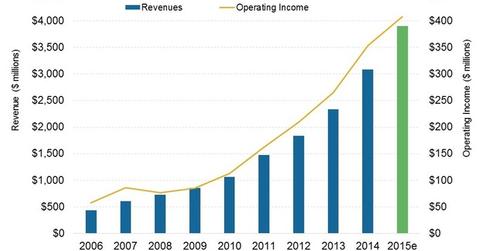

Under Armour is scheduled to declare its earnings for 4Q15 and full-year 2015 on January 28, 2016. It has projected revenue of $3.9 billion for 2015.

Jan. 21 2016, Published 4:01 p.m. ET

Under Armour to release 4Q15 and 2015 earnings on January 28

Athletic gear company Under Armour (UA) is scheduled to declare its earnings for 4Q15 and 2015 on January 28, 2016, before the market opens. The company has projected revenue of $3.9 billion for 2015, implying a sales number of ~$1.1 billion in 4Q15. This would imply a revenue growth rate of ~26% in 2015 and ~25% in 4Q15.

Under Armour is one of the only two companies in the S&P 500 Index (SPY) (IVV) (VOO) to have posted 21 straight quarters of 20%-plus growth in its top line. More importantly, the fitness gear company expects the trend to continue. It’s projecting annual sales of $7.5 billion by 2018, a compound annual growth rate of ~24.9% from 2014 to 2018.

What’s spurring sales and earnings for Under Armour?

Under Armour is the second-largest sports apparel company by sales in the United States. The company held an estimated 6% share of the overall market in 1Q15. Category leader Nike (NKE) held the first position with a 13% market share. Hanesbrands (HBI) and Adidas (ADDYY) both held ~3% of the market share[1. Source: Matt Powell, The NPD Group].

Under Armour’s sales have benefited from new and innovative launches of both products and categories and expansions in new sales channels and countries. The company has steadily gained share in the US market and has expanded its presence globally.

Under Armour and other companies competing in the industry have also benefited from the higher-than-average growth rates in the sports apparel category compared to the overall apparel industry. Consequently, mainstream apparel companies such as L Brands (LB) and The Gap (GPS) and designers such as Tory Burch have entered this space and now sport their own athleisure lines.

Under Armour and its rivals Nike, VF Corporation (VFC), and Hanesbrands make up 5.7% of the portfolio holdings in the Consumer Discretionary Select Sector SPDR ETF (XLY). XLY provides exposure to 88 stocks in the consumer discretionary sector.