Why Tiffany & Co. Is More Profitable than Its Competitors

Since 2006, Tiffany’s margins have been on the higher side compared to its peers, including Signet Jewelers and Fossil, in the retail jewelry industry.

Nov. 20 2020, Updated 11:28 a.m. ET

Tiffany’s margins

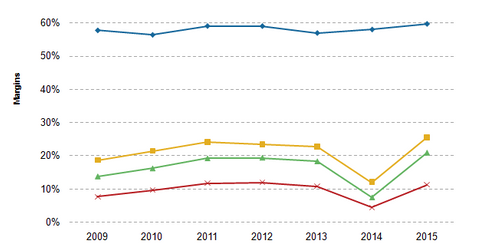

Since fiscal 2006, Tiffany & Co.’s (TIF) gross margin, EBITDA (earnings before interest, tax, depreciation, and amortization) margin, and operating margin have all seen fluctuations.

The company’s gross margin witnessed growth in the 2008–2009 recession period, but its EBITDA margin and operating margin fell during the period.

Tiffany more profitable than most peers

Since 2006, Tiffany’s margins have been on the higher side compared to its peers, including Signet Jewelers (SIG) and Fossil (FOSL), in the retail jewelry industry. But its margins were lower than privately-held Pandora (PNDORA.CO) (PNDZY).

Pandora, which designs, manufactures, and markets hand-finished and contemporary jewelry, has reported the highest gross margin, EBITDA margin, and operating margin in its peer group.

Why margins are high at Tiffany

At Tiffany, 65%–75% (by value) of the polished diamonds used in jewelry have been produced from rough diamonds that the company has purchased. Buying rough diamonds reduces the cost of merchandise and thereby increases profitability.

Tiffany is significantly investing in diamond and gemstone inventory to maintain its position in the high-end jewelry market. Therefore, Tiffany’s gross margins are expected to fall.

But the company has to purchase an assortment of rough diamonds from its suppliers. The assortment contains some rough diamonds that don’t meet Tiffany’s quality standards. The company thus sells these diamonds at a low price to third parties.

ETF exposure

Tiffany & Co. is a component of the SPDR S&P 500 ETF (SPY). Tiffany, Signet, and Fossil all have exposure in the iShares Russell 1000 Growth ETF (IWF) and the iShares Core S&P 500 ETF (IVV). Together, these companies form 0.12% of the portfolio holdings of IWF and 0.19% of the holdings of IVV.

IVV measures the performance of the large-cap (large capitalization) sector of the US equities market, tracking the top 500 stocks. IWF is a growth-oriented ETF. Tiffany and Signet together represent 2.1% of the SPDR S&P Retail ETF (XRT). Specialty retail companies form 18.1% of XRT.