Merck Will Soon See a Decision on Its New Hepatitis C Therapy

The FDA has scheduled the Prescription Drug User Fee Act (or PDUFA) date for Merck’s new hepatitis C combination therapy for January 28, 2016.

Dec. 17 2015, Updated 11:01 a.m. ET

PDUFA date

The U.S. Food and Drug Administration (or FDA) has scheduled the Prescription Drug User Fee Act (or PDUFA) date for Merck’s (MRK) hepatitis C (or HCV) combination therapy, grazoprevir/elbasvir (100mg/50mg), for January 28, 2016. The therapy is being tested for HCV patients belonging to genotype one, four, and six including difficult-to-treat patients such as those who have failed to respond to previous therapy, those with liver cirrhosis, those suffering from HIV and HCV co-infection, and those with chronic kidney diseases. The PDUFA date is a deadline by which the FDA announces its decision for new drugs.

The FDA may announce its decision before this date. However, the majority of new drugs are approved or rejected on the scheduled PDUFA date. The FDA’s decision is important for Merck investors, as it determines the future profitability of the company.

HCV market opportunity

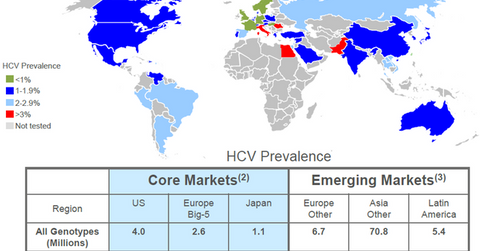

The above diagram shows that there are about 4 million people suffering from HCV in the US, of which 79% suffer from genotype 1 HCV. Additionally, 2.6 million people in the big five countries in Europe and 1.1 million people in Japan suffer from HCV. The prevalence of the disease is substantially higher in emerging economies with 70.8 million HCV patients in Asia, 5.4 million patients in Latin America, and 6.7 million patients in other European countries. This underlines the scale of opportunity available for HCV players such as Merck (MRK), Gilead Sciences (GILD), AbbVie (ABBV), and Bristol-Myers Squibb (BMY).

Priority review status

The FDA granted priority review status to grazoprevir/elbasvir (100mg/50mg) combination therapy on July 28, 2015. According to the FDA, “Priority review status is granted to applications for drugs that, if approved, would be a significant improvement in safety or effectiveness in the treatment of a serious condition.”

Investors can get exposure to a variety of innovative HCV drugs while reducing company-specific risks by investing in the SPDR S&P 500 ETF (SPY). SPY invests 0.82%, 0.65%, 0.84%, and 0.52% of its portfolio in Merck, Bristol-Myers Squibb, Gilead Sciences, and AbbVie, respectively.