Brent-WTI Spread Impacts Your Oil-Related Investments

On February 14, WTI crude oil (USO) (USL) (OIIL) (SCO) active futures traded at a discount of $2.84 per barrel compared to Brent crude oil active futures.

Nov. 20 2020, Updated 3:31 p.m. ET

Brent-WTI spread

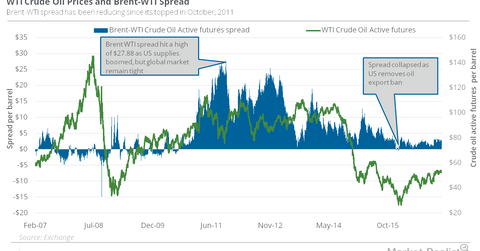

On February 14, 2017, WTI crude oil (USO) (USL) (OIIL) (SCO) active futures traded at a discount of $2.84 per barrel compared to Brent crude oil (BNO) active futures. Since OPEC’s deal in November 2016, the spread has almost doubled. A reduction in global crude oil supply outside the US, accompanied by rising US supply, could help explain why the Brent-WTI spread expanded after OPEC’s deal.

What impacted the Brent-WTI spread?

Historically, WTI and Brent crude oil traded close to each other. WTI is the easier crude to process. It’s being produced in the US—the world’s largest demand center. As a result, WTI predominantly traded at a small premium to Brent.

Around 2011, US oil production started booming on the back of high prices and technological advances unlocking its vast shale deposits. Along with rising imports from Canada, it caused a rise in supply in North America. However, US crude couldn’t be exported. Also, there wasn’t enough transportation capacity to get the booming inland supplies to the main demand center for the oil on the US Gulf Coast. The US Gulf Coast has most of the US refining capacity.

By October 2011, US crude oil production rose to 5.86 million barrels per day—the highest level since July 2002. During this time, other countries like China gained dominance as demand centers for crude oil derived fuels. In October 2011, WTI crude oil active futures traded at a discount of $27.88 per barrel compared to Brent oil active futures—a record level.

After various oil pipeline projects became functional in 2013–the spread gradually narrowed. The US removed the ban on domestically produced oil exports in December 2015. As a result, the Brent-WTI spread flipped into negative territory for the first time in five years. On January 15, 2016, WTI crude oil active futures traded at a premium of $0.48–the highest since August 16, 2010.

Why does the Brent-WTI spread matter to you?

The spread between Brent crude oil and WTI crude oil (UWTI) prices impacts US upstream producers (XOP), midstream transporters (AMLP), and downstream refiners (CRAK).

When US WTI crude oil is cheaper than Brent crude oil, it means that US upstream producers receive less money than their international counterparts for each barrel of oil they produce. However, the situation is more profitable for downstream US refiners because their input cost is lower in such a situation.

If WTI’s discount to Brent is deep enough to cover shipping and transportation costs, it could also be an opportunity for upstream or midstream companies to seek higher prices outside North America through exports. So far, US crude oil exports in 2017 are ~42% more than the same period in 2016.