Are Curtailments Enough to Offset New Capacity in Iron Ore?

The Nullagine joint venture, where BC Iron owns 75% and Fortescue Metals (FSUGY) owns 25%, will cease production in 2016 due to weak iron ore prices.

Dec. 22 2015, Published 1:19 p.m. ET

Capacity curtailments

Anglo American’s (AAUKY) Kumba iron lowered its reduction guidance for 2016 from 36 million tons to 26 million tons at its investor day on December 8, 2015. Additionally, it guided for a waste movement of 135 million tons, also below its previous guidance of 230 million tons. This would mean a ~40% reduction in moved material, and only a 15% reduction in saleable tons. The market remains concerned about the company’s ability to execute this plan and reduce unit costs at the same time.

The Nullagine joint venture, where BC Iron owns 75% and Fortescue Metals (FSUGY) owns 25%, will also cease production in 2016 due to weak iron ore prices. The venture has a capacity of ~5 million tons per annum (or Mtpa).

Capacity expansions

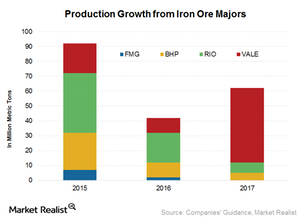

The closures or downgrades in production have been quite insignificant as compared to the supply, as the latter is expected to come online in 2016 and onward. The Roy Hill mine has completed its construction work and is expected to start shipments in December 2015. The project is expected to ramp up to its 55 Mtpa capacity in the next 15 months.

Vale’s (VALE) S11D project—a 90 Mtpa iron ore project—is also running per schedule. Vale expects S11D to produce iron ore at a cash cost of just $7 per ton. If this is achieved, Vale will have the lowest C1 cash cost in the world, even below BHP Billiton (BHP) (BBL) and Rio Tinto (RIO).

Net impact

The capacity curtailments are happening at the higher end of the industry cost curve as a reactive measure. Meanwhile, capacity additions are happening at the lower end of the curve. This will further flatten the cost curve.

As the cost curve flattens, the marginal support price for iron ore reduces. In turn, a lower marginal support price supports lower iron ore prices, leading to further weakness. Vale forms 2.3% of the iShares MSCI Brazil Capped ETF (EWZ).