How You Can Win More By Losing Less

Most investors focus much of their time on picking assets that have the potential to win. However, limiting downside risk is just as important.

Sept. 1 2020, Updated 12:02 p.m. ET

Veteran investor Dennis Stattman discusses the slow, steady road to investment success and how to build a portfolio a hare would envy, particularly when the terrain gets bumpy.

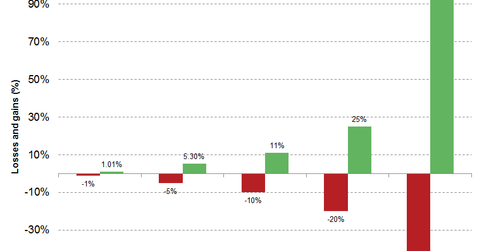

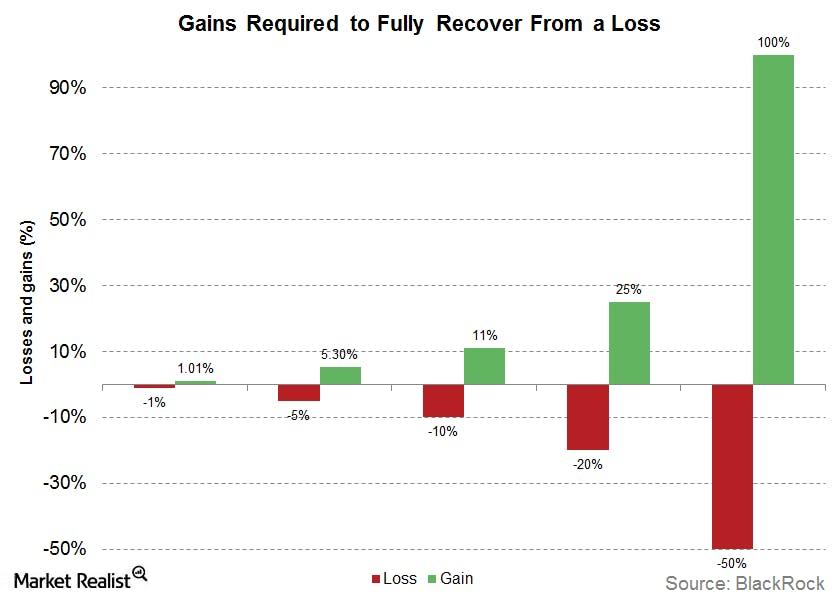

The further you fall, the harder it is to climb back up. It’s a universal truth that is painfully apparent in the investing world, as illustrated here:

That’s one reason Dennis Stattman of the BlackRock Global Allocation Fund much prefers a steady-as-she-goes path to investment returns. While his approach might mean giving up some blockbuster numbers during equity market booms, it can also mean a potentially less treacherous fall on downturns. In the long run, it’s that patient, steady (and studied) approach that can be more successful for investors. Call it “win more by losing less.”

Market Realist – Most investors focus much of their time on picking assets that have the potential to win. However, limiting downside risk is as important, if not more important, than picking winners in your portfolio.

Recovering from losses in your portfolio can take time. Moreover, there needs to be significant upward market movement (ITOT) for your portfolio to recover from the loss. The previous graph illustrates this point perfectly. For instance, to recover from a 20% drop in portfolio value, the market (VTI) would need to register a gain of 25% for the investor to break even. A loss in portfolio value of 50% would need a 100% gain in markets (VOO) to reach the break-even point. Assuming an annual market return of 9%, the investor would take more than eight years to recover from the loss.

According to estimates from Morningstar and AGF Investments, markets experience drops over 10% more frequently than they see gains over 10%. Between January 1992 and December 2014, there were 77 weeks where the S&P 500 (SPY) (IVV) registered losses of more than 10%. There were only 45 weeks with gains of over 10% during the time period. The cumulative value of the losses over the 77 weeks was -1096%. The cumulative value of the gains over the aforementioned 45 weeks was 612%.

This is why limiting downside risk can actually help investors win more in the long term. Investors can win more by losing less. A steady approach that balances risk by diversified investment in both global equity (ACWI) and bond markets (BND) can help investors in limiting their losses. We will explore how in the next part of the series.