Wider Crack Spread: Its Impact on Refiners

The recent rise in the crack spread is driven by factors like low crude oil prices, a rise in demand for gasoline, and a sharp rise in demand for propane.

Nov. 11 2015, Updated 12:06 a.m. ET

A rise in the crack spread

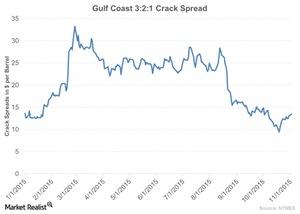

The benchmark US Gulf Coast 3:2:1 crack spread rose by ~29% to $13.465 per barrel on November 02, from $9.437 per barrel on September 19. The continuous uptrend in the crack spread for the past two weeks can be observed in the chart below.

Crack spread price movements

The crack spread is the price differential between three barrels of crude oil, two barrels of gasoline, and one barrel of distillate fuel that these products are assumed to be produced from the extraction process. It’s calculated to know the profit margin for refiners by cracking crude oil into refined products.

The crack spread will increase when refined products prices rise more than the price of crude oil, or when the price of crude oil falls more than the refined products’ prices. The recent rise in the crack spread is driven by factors like low crude oil prices, a rise in demand for gasoline, and a sharp rise in demand for propane and heating oil due to the winter season. All this helped in boosting the prices of refined products. From the chart above we can also observe that the crack spread started recovering from the month of October.

Impact of crack spread on refiners

The wider the crack spread, the more profitable it is for refiners such as Chevron (CVX), Valero Energy (VLO), Phillips 66 (PSX), Western Refining (WNR), Marathon Petroleum (MPC), and Tesoro (TSO).

All the above-mentioned companies are components of the iShares Global Energy ETF (IYE), the Vanguard Energy ETF (VDE), and the Energy Select SPDR ETF (XLE). Phillips 66 (PSX) makes up 7.5% of the iShares US Oil & Gas Exploration & Production ETF (IEO).