A Volatile Week for Crude Oil Prices: Analyzing the Key Reasons

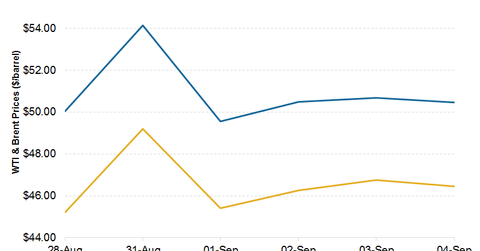

WTI crude oil prices closed 1.83% higher on a weekly basis at $46.05 per barrel in the week ended September 4. Brent crude fell by 0.87% on a weekly basis, closing at $49.61 on September 4.

Sept. 10 2015, Published 2:19 p.m. ET

Crude oil prices

WTI (West Texas Intermediate) crude oil prices closed 1.83% higher on a weekly basis at $46.05 per barrel in the week ended September 4. Brent crude fell by 0.87% on a weekly basis, closing at $49.61 on September 4.

When crude oil prices (USO) rise, it’s positive for oil producers such as Murphy Oil (MUR), Cimarex Energy (XEC), Hess (HES), and Diamondback Energy (FANG). MUR, XEC, and HES make up 2.6% of the Energy Select Sector SPDR ETF (XLE).

Higher crude oil prices benefit MLPs as well. MLPs such as Plains All American Pipeline Partners (PAA) transport crude oil. Higher prices could eventually translate into higher transported volumes for these MLPs, meaning higher revenues.

Weekly recap

Between Friday, August 28, and Monday, August 31, WTI crude oil prices spiked 8.8% to settle at $49.20 per barrel. Meanwhile, Brent increased 8.19% and closed at $54.15 per barrel. Prices increased after the EIA revised its monthly crude oil production estimates downward. Production in January through May was estimated to be 40,000 barrels per day (or bpd) to 130,000 bpd lower than originally estimated.

Additionally, the latest available production estimates for June equaled 9.3 million bpd—approximately 100,000 bpd lower than the revised May production estimate. The revised estimates were a result of the EIA changing its method of collecting data, which follows a survey-based approach. According to the EIA, “The survey-based approach improves estimates by representing more than 90% of oil production in the United States.”

Prices also spiked on Monday after OPEC’s (Organization of the Petroleum Exporting Countries) hints at a willingness to talk to crude oil producers to achieve reasonable prices, boosting speculation that it might be considering curbing output.

However, WTI prices plunged on Tuesday, canceling out earlier gains after the Chinese PMI (purchasing managers’ index) fell to 49.7 from 50 in July. This reading is the lowest in three years. The PMI is an indicator of a country’s manufacturing activity. A PMI slowdown indicates weakening demand. This is negative for crude oil prices, given that China is the world’s second largest crude oil consumer. WTI fell 7.7% to settle at $45.41 per barrel. Brent fell ~8.5% and settled at $49.56 per barrel on Tuesday.

Stock rally revives crude prices

Prices bounced back on Wednesday after a rally in US stocks, but a bearish inventory report released by the EIA kept a lid on prices. However, the report also showed a drop in Cushing inventories after increasing for two straight weeks. This news also helped prices. Read more about last week’s crude inventory report at US Crude Oil Inventories Rise More than Expected.

WTI crude gained ~1.85% to settle at $46.25 per barrel, and Brent gained 1.89%, settling at $50.50 per barrel on Wednesday.

On Thursday, WTI crude oil and Brent prices increased two days in a row on the news that the European Central Bank could be considering an expansion in its stimulus program. This could eventually improve the demand for crude oil. WTI gained ~1.08% to settle at $46.75 per barrel while Brent crude oil increased by ~0.35% to close at $50.68 per barrel on Thursday.

On Friday, September 4, prices retreated after the latest jobs report sent mixed signals. WTI fell ~1.5% on Friday, and Brent decreased ~2% to settle at $46.05 and $49.61 per barrel, respectively.