What Was D.R. Horton’s Cost Structure Breakdown in 2014?

Cost of homes sold is the highest of the company’s costs at 78.1%, followed by SG&A at 10.6%, and cost of land sold at 1.6%.

July 23 2015, Updated 11:06 a.m. ET

Cost structure of D.R. Horton

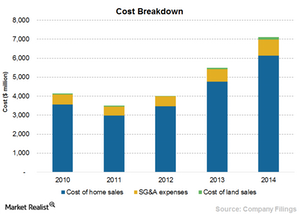

The total homebuilding cost of D.R. Horton (DHI) was at $7.1 billion for fiscal 2014, a rise of 29.1% over 2013. Cost of homes sold is the highest of the company’s costs at 78.1%, followed by SG&A (or selling, general and administrative) at 10.6%, and cost of land sold at 1.6%.

Peer group comparison

The cost of homes sold amounted to $6.14 billion in 2014 compared to $4.77 billion in 2013, up by 28.7%. The cost of homes sold includes the cost of land acquisition, land development, and construction material costs like lumber and roofing products. The cost of homes sold as a percentage of total homebuilding revenue has been declining consistently from 83.7% in 2011 to 78.1% in 2014. This was due to an increase in average selling price and strict control over expenses.

Though the cost of homes sold as a percentage of revenue has been declining, it still is higher compared to its major competitors such as Lennar (LEN) at 72.6%, Pulte Group (PHM) at 76.2%, but lower compared to KB Homes (KBH) at 81.2%.

Sharp growth in employee cost

D.R. Horton’s SG&A expenses were $834.2 million in fiscal 2014, compared to $650 million in 2013. As a percentage of total homebuilding revenue, SG&A expenses improved to 10.6% in 2014 compared to 13.5% in 2011.

The improvement in SG&A expenses as a percentage of revenues was due to an increase in both the volume and the average selling prices of homes closed, combined with the company’s efforts to keep the growth in overhead expenses at a lower level than the growth in home closings volume and revenues. Overall, the total homebuilding cost as a percentage of homebuilding revenue was at 90.4%, the lowest since 2011 when it was at 98.7%.

Employee cost represented 64% of SG&A cost in 2014 compared to 65% in 2013. These costs increased by 26% in 2014 to $536.9 million over a year ago, mainly due to an increase in number of employees and an increase in incentive compensation related to the increase in profitability in many divisions. Employee strength of homebuilding operations increased by 925 in fiscal 2014 to 4,525. The rising employee strength indicates the rise in market opportunities for the company.

Investors who are interested in trading the sector as a whole should look at the SPDR S&P Homebuilders ETF (XHB).