Why Coca-Cola Will Benefit from Restructuring Its Bottling System

Coca-Cola (KO) is strengthening its bottling system around the world so it can devote more time to its core concentrate business and marketing efforts.

Oct. 1 2015, Updated 8:05 a.m. ET

Focus on core business

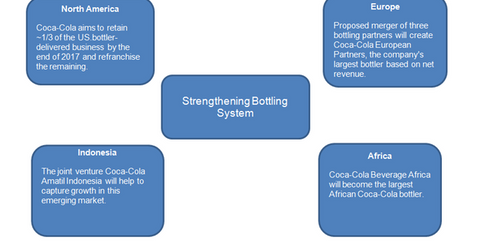

In part 1 of this series, we mentioned two strategic initiatives that Coca-Cola (KO) is implementing to transform its business: adapting its segmented revenue approach and focusing on its core business model. The company is strengthening its bottling system around the world so it can devote more time to its core concentrate business and marketing efforts.

Coca-Cola sells its finished beverages with the help of company-owned bottling operations. It also sells concentrates to authorized bottling partners that manufacture and distribute the final product. The company wants to focus on its high-margin concentrate business and bring down its investment in the capital-intensive bottling business in some markets.

Refranchising in North America

Coca-Cola is reducing its exposure to the low-margin bottling business in North America by refranchising its bottling operations in the region. During 2Q15, Coca-Cola refranchised territories representing more than 5% of the US bottle and can volume. The company is on track to achieve its goal to refranchise two-thirds of its bottling operations by the end of 2017.

Coca-Cola European Partners

On August 6, three of Coca-Cola’s bottling partners announced their intentions to merge to form Coca-Cola European Partners. The three bottlers that will combine forces are Coca-Cola Enterprises (CCE), Coca-Cola Iberian Partners (or CCIP), and Coca-Cola Erfrischungsgetränke AG (or CCEAG). When formed, Coca-Cola European Partners will be Coca-Cola’s largest bottler based on a pro forma 2015 expected net revenue of $12.6 billion.

The new entity will include 50 bottling plants and will serve more than 300 million consumers in 13 countries across Western Europe.

Bottling operations in other regions

In November 2014, Coca-Cola, SABMiller (SBMRY) (SAB.L), and Gutsche Family Investments announced an agreement to combine the bottling operations of Southern and East Africa. Coca-Cola will have an 11% ownership in the new entity, which will be called Coca-Cola Beverages Africa Limited. The transaction, which is expected to close in the second half of 2015, will create the largest Coca-Cola bottler in Africa.

In October 2014, Coca-Cola announced a joint venture with Coca-Cola Amatil Indonesia to accelerate its growth in the region. Coca-Cola makes up 0.4% of the portfolio holdings of the iShares MSCI ACWI ETF (ACWI) and 1.5% of the iShares Russell 1000 Growth ETF (IWF).

The bottling and distribution networks of Coca-Cola and PepsiCo (PEP) give them an edge over smaller players like Dr Pepper Snapple (DPS) and Monster Beverage (MNST), which have been depending on them for distribution of some of their key brands.

In the next part of this series, we’ll take a look at Coca-Cola’s growth strategy for still beverages.