SBMRY

Latest SBMRY News and Updates

Anheuser-Busch InBev Bids for SABMiller: Analysis

On October 7, Anheuser-Busch InBev announced a formal cash bid of 42.2 pounds per share to SABMiller’s board. This was the third offer rejected by SABMiller.

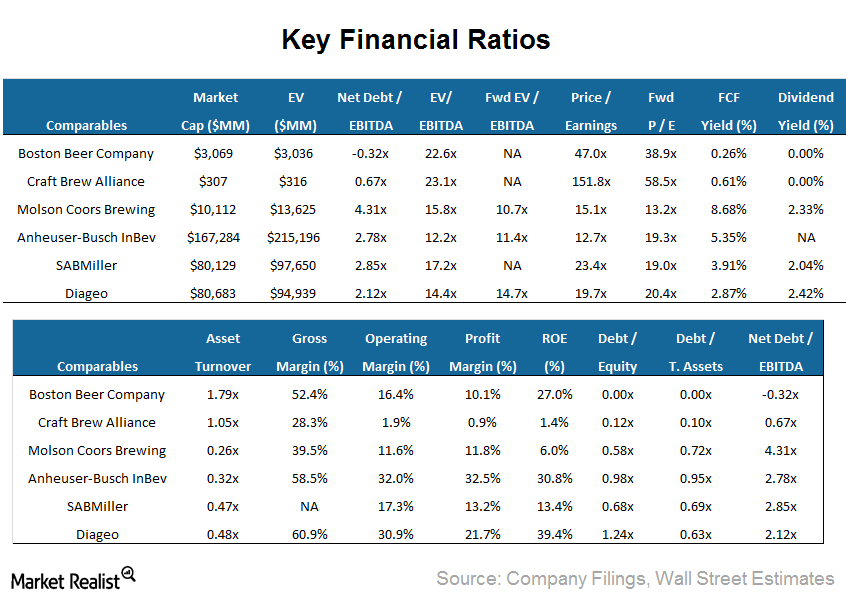

Boston Beer Company: An introduction to better beer business

Boston Beer Company Inc. (SAM) is the largest craft brewer in the United States, having sold ~2.7 million barrels of proprietary core brand products.

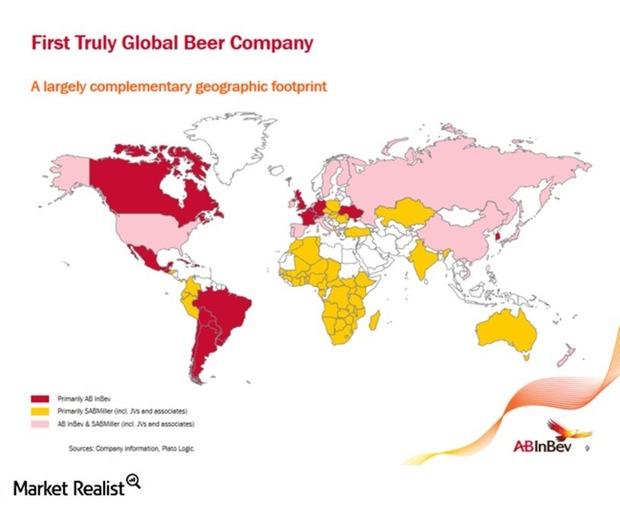

Projected Synergies from an Anheuser-Busch InBev–SABMiller Deal

ABI is a leading company in the consumer staples sector. It has had a strong record of integrating acquisitions and delivering synergies ahead of target.

Anheuser-Busch InBev’s Acquisition of SABMiller: Divestitures at a Glance

ABI has been one of the most active companies in the acquisition of other beer firms. The Belgium-based company itself came from a prior $52 billion deal.