Investment-Grade Bond Funds Saw Outflows Last Week

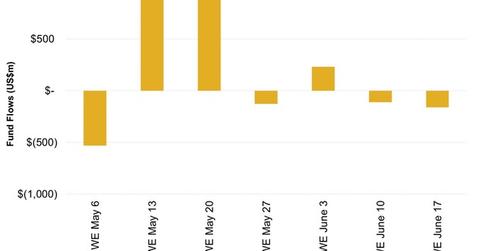

Flows into investment-grade bond funds (LQD) were negative in the week ending June 17. This was the second consecutive week witnessing outflows.

Nov. 20 2020, Updated 1:38 p.m. ET

Investor flows

Flows into investment-grade bond funds (LQD) were negative in the week ending June 17. This was the second consecutive week witnessing outflows. Investment-grade bond funds (AGG) saw net outflows of $161.2 million. In comparison, outflows amounted to $109.8 million in the previous week. Last week’s outflows were the fifth week of outflows this year. All 2015 outflows have occurred since April.

Even with these outflows, investment-grade bonds have attracted inflows of $28.9 billion in 2015 year-to-date.

Investment-grade corporate bond issuers were cautious about raising debt last week due to the Federal Reserve’s monetary policy statement. Very little issuance was seen prior to the statement’s release.

Baxalta, a wholly owned subsidiary of Baxter International (BAX), Energy Transfer Partners (ETP), JPMorgan Chase (JPM), Occidental Petroleum (OXY), and Cardinal Health (CAH) were the biggest issuers of investment-grade bonds in the week ending June 19. You can read the details of these issues in Part 4 of this series.

Yield analysis for corporate high-quality debt securities

Investment-grade bond yields usually follow cues from the Treasuries market. Treasury yields fell across the yield curve week-over-week, leading to similar movement in investment-grade corporate bond yields. Investment-grade corporate bond yields had continued to fall almost throughout the week and ended at 3.25% on June 19, a loss of eight basis points from the previous week, according to the BofA Merrill Lynch US Corporate Master Effective Yield.

The OAS (option-adjusted spread) rose four basis points week-over-week to end at 1.44%. The OAS measures the average difference in yields between investment-grade bonds and Treasuries. A rise in this spread implies that the risk of high-grade bonds relative to Treasuries has increased.

Price of investment-grade debt ETFs rises

As yields fell, prices of investment-grade bond ETFs rose due to the inverse relationship between prices and yields. Price of the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) rose by 0.6% in the week ending June 19. In the same period, the iShares Core Total US Bond Market ETF (AGG) and the Vanguard Total Bond Market ETF (BND) rose by 0.6% and 0.5%, respectively.

For more bond market trends and analysis, please visit Market Realist’s Fixed Income ETFs page.