Cardinal Health Inc

Latest Cardinal Health Inc News and Updates

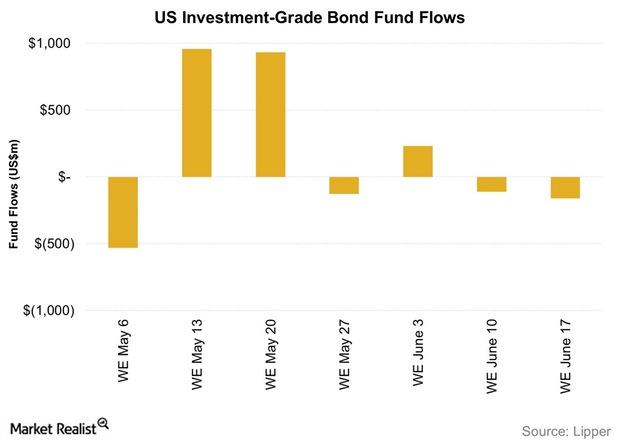

Investment-Grade Bond Funds Saw Outflows Last Week

Flows into investment-grade bond funds (LQD) were negative in the week ending June 17. This was the second consecutive week witnessing outflows.

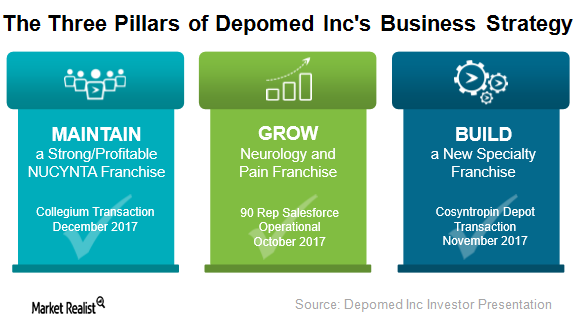

Behind Depomed’s Business Strategy

Depomed (DEPO) has adopted a three-pronged business strategy with three key elements: maintain, build, and grow.

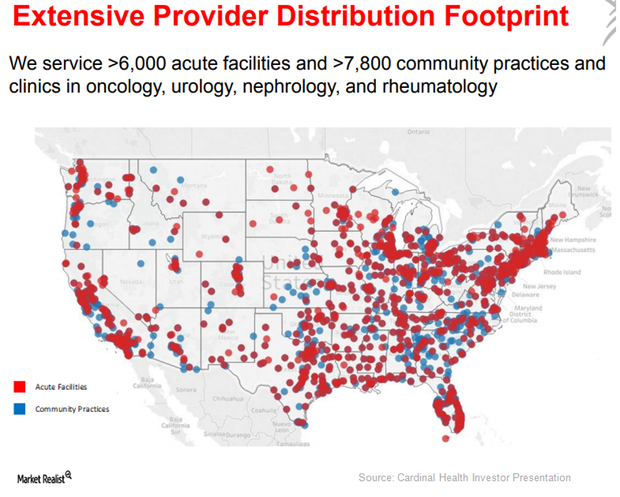

Robust Growth Expected for Cardinal Health’s Specialty Solutions

Cardinal Health’s (CAH) Specialty Solutions segment provides two types of services: upstream to pharmaceutical and biopharmaceutical manufacturers and downstream to healthcare providers.

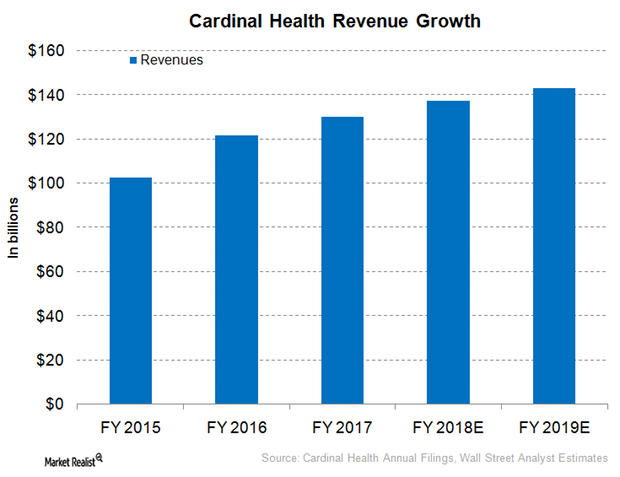

Cardinal Health Expected to Report Modest Revenue Growth

For fiscal 2018, Cardinal Health (CAH) has projected mid-single-digit revenue growth on a YoY basis, partially driven by the company’s high customer retention rates.

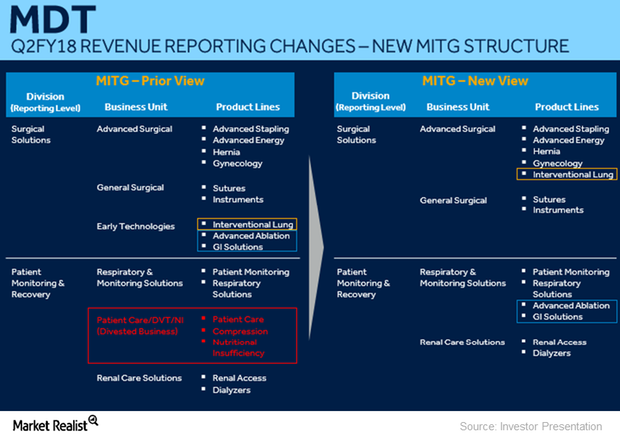

Divestiture of a Part of Medtronic’s PMR Business to Cardinal Health

Medtronics’ MITG (Minimally Invasive Therapies Group) business is expected to grow 3.5%–4.5%.

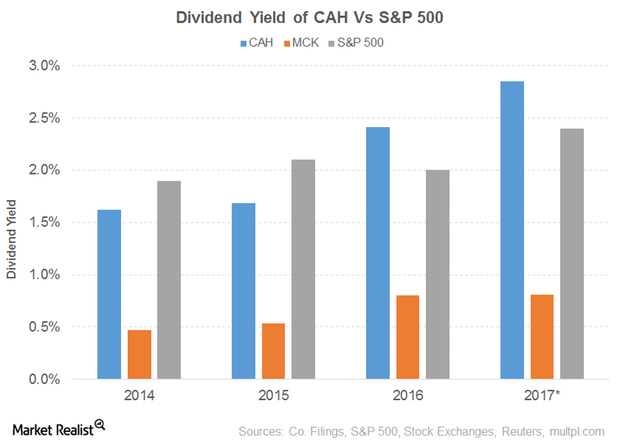

Dividend Yield of Cardinal Health

Cardinal Health’s (CAH) PE ratio of 16.0x compares to a sector average of 20.4x. The dividend yield of 2.9% compares to a sector average of 2.0%.

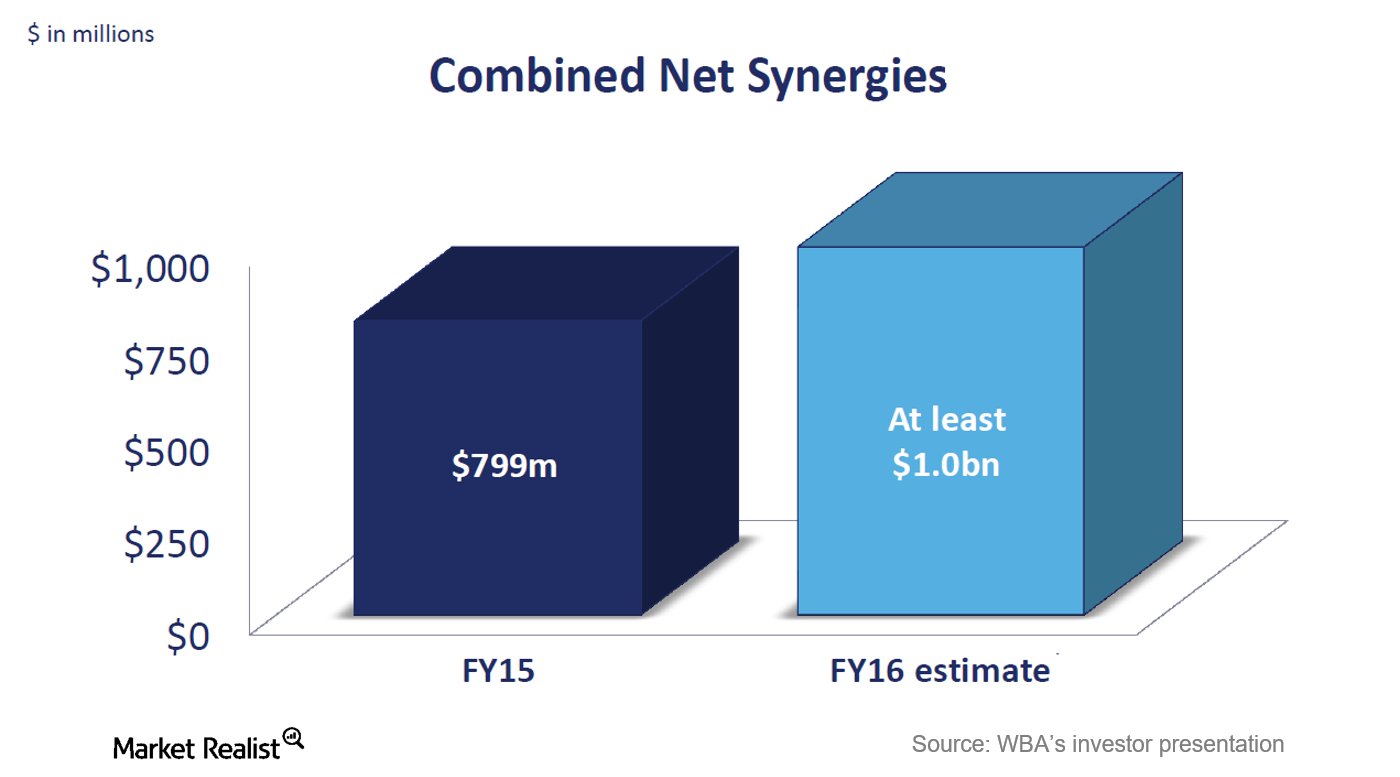

Walgreens Boots Alliance: Merger of Walgreens and Alliance Boots

Walgreens became a wholly owned subsidiary of Walgreens Boots Alliance after a merger.

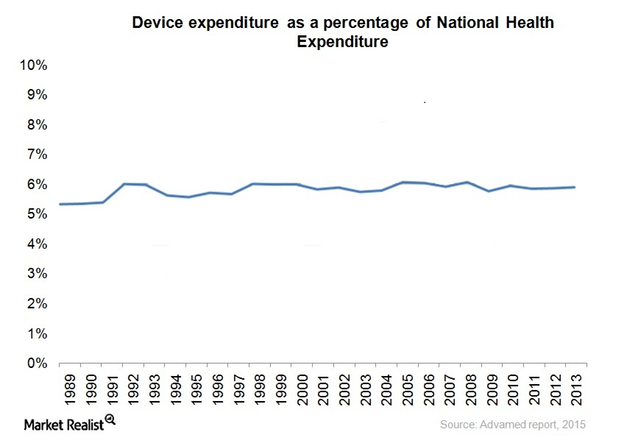

Analyzing Cost Structure for Medical Device Companies

As per the US Census, spending on medical devices in the US has been constant for over a decade between 2005 to 2015.

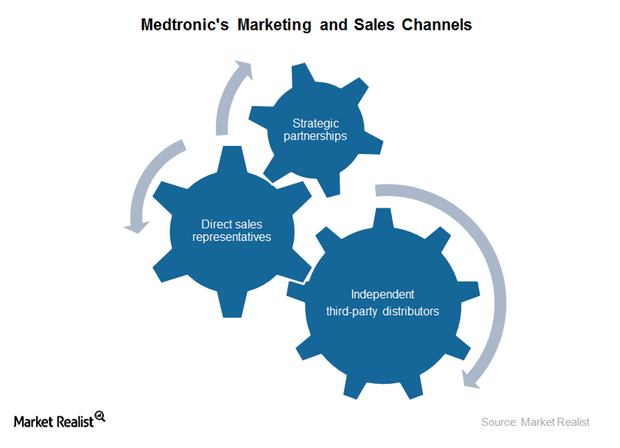

Assessing Medtronic’s Marketing and Sales Strategy in 2015

To extend cost-effective, high-quality medical devices and therapies, Medtronic aims to organize its marketing and sales teams around physician preferences.