PulteGroup’s Debt-to-Equity Ratio Is the Lowest in the Industry

PulteGroup’s debt-to-equity ratio peaked to 1.7x in 2011. Since then it has been declining consistently due to debt reduction and stock repurchase initiatives.

Aug. 12 2015, Updated 9:05 p.m. ET

Managing debt is essential

As we have seen in our Home, sweet home: Your guide to the homebuilding industry series, homebuilding is a very capital-intensive business that needs continuous availability of capital to run the show. Thus, managing an adequate debt-to-equity ratio is essential for long-term survival of the company.

PulteGroup’s debt reduction spree

As a result of higher costs of servicing debt during downturns, PulteGroup (PHM) decided to reduce its debt level from the peak of the housing boom. During the last five years, PulteGroup significantly reduced its outstanding debt through a variety of transactions. The company’s total debt declined by 46.4% from $3.4 billion in 2010 to $1.82 billion in 2014. The company reduced its outstanding senior notes by $245.7 million, $461.4 million, and $592.4 million during 2014, 2013, and 2012, respectively. The average interest rate on the outstanding debt was 5.25% at the end of fiscal 2014 compared to 5.24% in the previous year.

Stock repurchase programs

The company repurchased 12.9 million and 7.2 million shares for a total of $245.8 million and $118.1 million in 2014 and 2013, respectively. This came on the back of stock repurchases worth $297.7 million in 2006. Such repurchases are reflected as a reduction of common stock.

Lowest debt-to-capital ratio

At the end of fiscal 2014, PulteGroup’s homebuilding debt to total capitalization was 27.5%, which improved from 31% in 2013 and 53% in 2012. The company’s debt to total capitalization is much better compared to that of industry peers. For example, D.R. Horton’s (DHI) debt to total capitalization was 27.5%, while for Lennar (LEN) it was 44.1%.

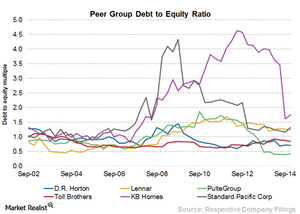

Debt to equity is lowest among peers

PulteGroup’s debt-to-equity ratio peaked to 1.7x in 2011. Since then it has been declining consistently due to debt reduction and stock repurchase initiatives, as we discussed above. For fiscal 2014, the company’s debt-to-equity ratio was at 0.4, the lowest in the industry. In contrast, KB Homes (KBH) had a debt-to-equity ratio of 1.76, followed by Standard Pacific (SPF) at 1.33, Lennar (LEN) at 1.25, and D.R. Horton (DHI) at 0.7.

Companies that are highly leveraged often find it difficult to grow because of the high cost of servicing the debt. Though the companies with higher financial leverage are more volatile, they will provide higher returns when fundamentals are favorable. On the other hand, debt does not dilute the owner’s ownership interest in the company.

Investors looking for diversification in the homebuilding sector can consider homebuilding ETFs such as the SPDR S&P Homebuilders ETF (XHB) and the iShares Dow Jones US Home Construction Index Fund (ITB).