How to Invest in D.R. Horton through ETFs

D.R. Horton sees allocation in major homebuilding sector-specific ETFs like the iShares Dow Jones US Home Construction Index Fund (ITB).

Nov. 20 2020, Updated 11:23 a.m. ET

ETFs are a good way to meet asset allocation

Asset allocation is a primary factor responsible for investment returns, and ETFs (or exchange-traded funds) are a convenient way for investors to build a portfolio that meets specific asset allocation needs. For example, an investor seeking an allocation of 70% stocks and 30% bonds can easily create such a portfolio with ETFs. In this article, we’ll see how sector-specific and sector-agnostic ETFs invest in D.R. Horton (DHI) stock.

Sector-specific ETFs

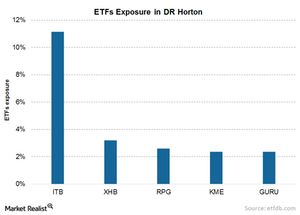

D.R. Horton is a major stock on NYSE with a market capitalization of $10.1 billion and is part of key stock market indices like the S&P 500 Index. Consequently, D.R. Horton sees allocation in major homebuilding sector-specific ETFs like the iShares Dow Jones US Home Construction Index Fund (ITB), which has a 11.15% stake in the company. The other major homebuilding sector-specific ETF is the SPDR S&P Homebuilders ETF (XHB), which has a 3.19% exposure in D.R. Horton. Homebuilder ETFs also have exposure to other stocks such as Lennar (LEN), Toll Brothers (TOL), KB Homes (KBH), and Ryland Group (RYL).

The iShares Dow Jones US Home Construction Index Fund (ITB) has an asset base of $2.17 billion and an expense ratio of 0.43%, while the SPDR S&P Homebuilders ETF (XHB) has an asset base of $1.78 billion and an expense ratio of 0.35%.

Sector-agnostic ETFs

The holdings of a particular company in an ETF depend on the investment objective of the ETF. Consequently, sector-specific ETFs should have a higher exposure to companies in the sector than sector-agnostic ones. We outline the holdings of various ETFs in the above chart.

Sector-agnostic ETFs like the S&P 500 Pure Growth ETF (RPG) and the SPDR KBW Mortgage Finance ETF (KME) also have exposure in D.R. Horton. RPG has a 2.59% stake in D.R. Horton, followed by KME with 2.35%. The S&P 500 Pure Growth ETF (RPG) had an asset base of $2.07 billion and an expense ratio of 0.35%.