What Helped Alaska Air Group Drive its 2Q15 Earnings?

Adding newer destinations Alaska Air Group (ALK) added a number of new routes in the second quarter of 2015, such as: Boise to Reno Eugene to San Jose, California Los Angeles to Baltimore Los Angeles to Gunnison–Crested Butte Los Angeles to Monterey Los Angeles to San Jose, Costa Rica Portland to Austin Seattle to Charleston […]

Dec. 4 2020, Updated 10:53 a.m. ET

Adding newer destinations

Alaska Air Group (ALK) added a number of new routes in the second quarter of 2015, such as:

- Boise to Reno

- Eugene to San Jose, California

- Los Angeles to Baltimore

- Los Angeles to Gunnison–Crested Butte

- Los Angeles to Monterey

- Los Angeles to San Jose, Costa Rica

- Portland to Austin

- Seattle to Charleston

- Seattle to Nashville

- Seattle to Raleigh–Durham

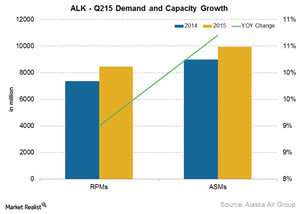

These new routes help the company expand its network, and adding nonstop destinations helps the company increase its customer satisfaction ratings. As we discussed earlier, Alaska Air Group has increased its capacity by 10.7% in 2Q15, which was higher than most of its competitors.

Strong demand for travel

As we discussed previously, Alaska Air Group saw strong demand for travel, with traffic growing at 9% year-over-year. The number of revenue passengers also grew at the same pace.

Focus on customer satisfaction

Alaska Air Group has historically focused on customer satisfaction. Along the same lines, the company started offering passengers the option to upgrade to Preferred Seating. This gives passengers the ability to select bulkhead and exit row seating 24 hours in advance of the flight.

The airline also provides features such as priority boarding and a complimentary drink, which has led to added revenue streams for the company.

Lower costs boost bottom line

Alaska Air Group has been focused on improving its CASM (cost per available seat miles). The company uses a number of cost-cutting measures, including:

- replacing aging aircraft in its fleet

- redeploying aircraft capacity during the winter to counter the impact of harsh weather conditions

- increasing the proportion of its total bookings through its website

- fuel hedging to protect against price spikes

- subcontracting several services to third-party vendors

All these measures have helped the company attain a low-cost structure. The company successfully reduced its operating expenses by 4% year-over-year during this quarter.

Lower fuel costs

The fall in crude prices has benefited many airline companies, including JetBlue Airways (JBLU) and United Continental (UAL). Airlines that had aggressive or no hedging strategies in place, like Delta Air Lines (DAL) and American Airlines (AAL), did not see this benefit. Alaska Airlines is one company that benefited from the fall in crude prices. The company follows a simple hedging strategy—it only buys call options as protection against upside spikes. This strategy helped the company gain from the recent worldwide fall in crude oil prices.

Investors can gain exposure to airline stocks through the iShares Transportation Average ETF (IYT). IYT holds ~16.85% in airline stocks. You can also invest in the SPDR S&P Transportation ETF (XTN).