What Were Southwest’s Key Performance Drivers for 1Q15?

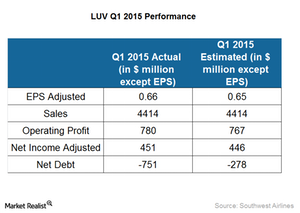

Southwest Airlines posted excellent financial performance metrics in 1Q15, including ~6% growth in available seat miles.

April 30 2015, Published 4:04 p.m. ET

Southwest on a growth trajectory

Southwest Airlines (LUV) posted excellent financial performance metrics in 1Q15, including ~6% growth in available seat miles (or ASM). The first quarter saw a 4.1% increase in stage length and a 2.7% increase in seats per trip (or gauge) because of fleet modernization. Southwest continues to see strong bookings, leading to higher revenues.

The addition of new destinations and the optimization of its route network helped Southwest post strong financial results. The company expects approximately 7% growth year-over-year in ASM, compared with 2014. Its estimated incremental fleet growth in 2016 is ~2% compared with 2015’s fleet growth. Southwest’s current fleet stands at 700 aircraft, and a 2% increase in its fleet would bring the total to 714 aircraft.

In the last five years, Southwest has grown more than 240%, and unit revenues have remained flat. However, unit expenses have declined, and total operational costs declined by around 12.5%. The major contributor toward this decline is the reduction in oil prices.

Reduced fuel costs

The most significant impact on Southwest’s performance came from the reduction in oil prices. In this quarter, Southwest incurred fuel costs of $2.00 per gallon, compared with $3.08 per gallon in 1Q14. This helped the company save fuel costs of more than $450 million. Also, the company entered into fuel derivative contracts to help it maintain comparable fuel costs of $2.00 per gallon in the second quarter of 2015.

The fuel costs per gallon for LUV’s peers in 1Q15 were:

- American Airlines (AAL): $1.83

- Alaska Airlines (ALK): $1.97

- Delta Air Lines (DAL): $1.99

- JetBlue Airways (JBLU): 2.06

- United Continental (UAL): $2.08

- Spirit Airlines (SAVE): $2.61

- Virgin America (VA): $2.93

These airlines are part of many ETFs, including the iShares Transportation Average ETF (IYT), with 38% of its holdings in airline stocks, as well as the PowerShares DWA Consumer Cyclicals Momentum Portfolio ETF (PEZ), which has 5.59% of its holdings in airline stocks.

However, the company had previously hedged against higher fuel prices, which is expected to cause losses. We will analyze this in detail in the next part. Despite these fuel derivative contract losses, the company will probably save $1 billion in 2015.

Renewed frequent flyer plan

Southwest is renewing its Rapid Rewards frequent flyer plan, which attracts regular passengers and encourages customer loyalty. This will help the company in maintaining its customer base in a highly competitive environment, especially among the low-cost carriers.