Key Indicators Impacting Gold Price Performance

Gold prices are holding steady in April. The SPDR Gold Trust ETF traded at $115.43 on April 15, almost flat when compared with April 1’s value of $115.60.

April 20 2015, Updated 2:48 p.m. ET

Gold price performance

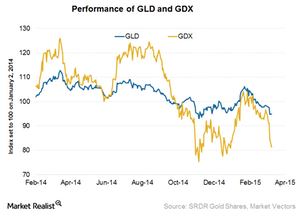

Gold prices are holding more or less steady in April. The SPDR Gold Trust ETF (GLD), which tracks the movement of gold prices, was trading at $115.43 on April 15, almost flat when compared with the April 1 value of $115.60. However, there has been a lot of sideways movement in the gold market.

The VanEck Vectors Gold Miners ETF (GDX), which tracks the movement of large and intermediate gold stocks, was up 4% in the first half of April.

Gold indicators

Gold prices are impacted by a host of variables. In this series, we’ll look at factors that investors can track to get a sense of the direction of gold prices. Investors usually view gold as an inflation hedge. As a result, gold prices are influenced by the following related factors:

- the macroeconomic outlook for the United States and other world economies

- the performance of alternative assets such as equities, bonds, and the US dollar

- interest rates

- inflation

We’ll also look at the impact of US data on the dollar and gold prices, and we’ll look at the influence of international data. Then we’ll discuss factors such as the US labor market, inflation, and inflation expectations. These are the most important considerations the Fed reviews before deciding on the quantum and timing of rate hikes. The timing of the Fed rate hike expectation has been the single most important variable impacting gold prices lately.

Get a holistic view

Most of these indicators are published monthly, while others are published weekly and quarterly. Although strongly correlated, these indicators are subject to divergences and short-term statistical noise. The best approach to getting a full picture is to look at these indicators as a whole rather than individually.

These indicators should point you in the same direction as gold prices. They’ll also suggest movements in the share prices of companies such as Goldcorp (GG), Royal Gold (RGLD), Silver Wheaton Corp. (SLW), and Kinross Gold Corporation (KGC). Combined, these companies make up 19.7% of GDX.

The iShares US Basic Materials ETF (IYM) is also a good way to invest in US basic materials stocks. RGLD forms 0.69% of its holdings.