Investing in gold? Watch the US Dollar Index

Tracked by the Federal Reserve, the weekly US Dollar Index measures the value of the dollar compared to the currencies of its significant trading partners.

Oct. 8 2020, Updated 1:25 p.m. ET

The US dollar and gold

Gold is traded mainly in US currency, so a weaker dollar makes gold less expensive for other nations to purchase. When the price of gold goes down, it logically increases demand for the precious commodity. Also, when the dollar starts to lose value, investors look for a good alternative investment, such as gold, in which to store that value. Gold’s value fluctuates as a result of the strength of the US dollar and the US economy.

Tracking the dollar

Tracked by the Federal Reserve, the weekly US Dollar Index measures the value of the dollar compared to the currencies of its significant trading partners. A rising index value means the US dollar is stronger than other currencies. Between February 5 and February 20, 2015, the index value increased from 113.59 to 114.42, a gain of 0.7%. And though this isn’t as much of a gain as we saw last month, the US dollar remains quite strong.

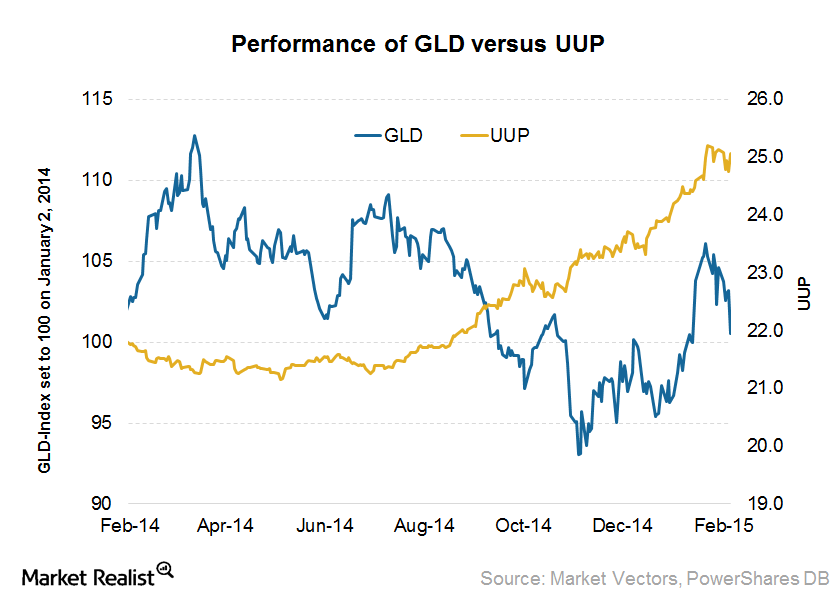

In 2014, the US dollar rose by 9% in value. The above chart shows the performance of the world’s largest physical-gold-backed ETFs, including the SPDR Gold Trust (GLD) and the PowerShares DB US Dollar Index Bullish Fund (UUP), which tracks the value of the US dollar relative to a basket of world currencies. The six major world currencies in this basket are the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc.

Why the US dollar is strong

The dollar’s strength can be attributed to falling oil prices, a strengthening US economy—as evidenced by a positive jobs report and consumer confidence—and soft growth in other parts of the world, including Japan, China, and Europe.

Rising US interest rates will contrast starkly to loosening monetary policies by the Eurozone and Japan. This contrast is likely to make US-denominated assets more attractive than other currencies, and push the US dollar even higher.

A strengthening US dollar usually leads to pressure on gold prices. But there are other factors that impact the US dollar that we’ll discuss later in this series.

A stronger dollar has a fallout impact on gold prices, which in turn affect gold stocks such as Agnico Eagle Mines (AEM), Goldcorp (GG), Newmont Mining (NEM), and Kinross Gold (KGC). AEM, GG, NEM, and KGC respectively make up 5.3%, 10.2%, 7.6%, and 3.1% of the VanEck Vectors Gold Miners ETF (GDX).

Investors need to keep in mind that sometimes, relationships change. For example, both the US dollar and gold have been rallying since the start of 2015. And this is because uncertainty leads investors toward the most assured, quality options available.