Why Pfizer’s Leverage Is Important to Investors

Leverage ratios determine the company’s ability to repay its debt. Leverage ratios directly affect the credit ratings. Pfizer has good credit ratings.

April 2 2015, Updated 12:06 p.m. ET

Understanding leverage for Pfizer

Pfizer (PFE) is one of the large pharmaceutical companies. It has operations in many countries. The company uses equity and debt for its working capital requirements and business investments.

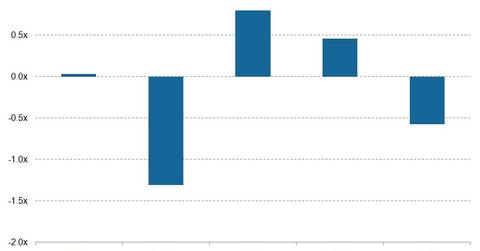

Net debt-to-EBIDTA

Net debt-to-EBITDA (earnings before interest, tax, depreciation, and amortization) is a measure of leverage. It’s calculated as a company’s interest-bearing liabilities minus cash or cash equivalents, divided by its EBITDA. If a company has more cash than debt, the ratio can be negative.

The above chart shows a comparison of net debt-to-EBITDA for Pfizer and other companies including Bristol-Myers Squibb (BMY), Eli Lily and Co. (LLY), Merck & Co. (MRK), and Johnson & Johnson (JNJ). For Bristol-Myers Squibb and Johnson & Johnson, the cash and marketable securities are higher than the total debt. This leads to negative net debt-to-EBITDA.

Total debt-to-equity

Total debt-to-equity is a measure of financial leverage. It’s calculated as total debt liabilities, divided by its shareholders’ equity. Pfizer’s total debt-to-equity ratio is 51.22%. The ratio for Bristol-Myers Squibb, Eli Lily and Co., Merck & Co., and Johnson & Johnson is 52.27%, 52.35%, 43.87%, and 26.90%.

Credit ratings and leverage

Leverage ratios determine the company’s ability to repay its debt. Leverage ratios directly affect the credit ratings. When a company has a higher net debt-to-EBITDA ratio, it suggests that the company may not be able to service its debt in an appropriate manner. This lowers its credit rating. Similarly, a lower net debt-to-EBIDTA ratio will help the firm take more debt as needed. It makes the credit rating relatively high.

For Pfizer, credit rating agencies Standard & Poor’s and Moody’s gave an AA and A1 rating for long-term debt, respectively. These are considered good ratings by the lenders.

Debt capacity

Pfizer has available lines of credit and revolving credit agreements with a group of banks and other financial intermediaries. The company maintains cash and cash equivalent balances and short-term investments in excess of its commercial paper and other short-term borrowings. As of December 31, 2014, the company had access to $8.4 billion in lines of credit.

Of this, $8.1 billion aren’t used. At the company’s request, lenders agreed to loan it $7.1 billion. Also, there’s $7 billion in lines of credit that isn’t used. All of it will expire in 2019. The company could use it to support the commercial paper borrowings.

Pfizer forms about 7.35% of the iShares US Healthcare ETF (IYH).