What Were Johnson & Johnson’s Outstanding Expenses?

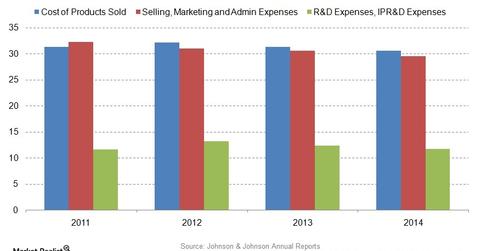

As a percentage of sales, Johnson & Johnson achieved lower expenses for 2014—compared to 2013. It was able to improve its gross profit margins.

March 16 2015, Updated 3:06 p.m. ET

Expenses

As a percentage of sales, Johnson & Johnson’s (JNJ) net profit increased from 19.4% in 2013 to 22% in 2014. The company achieved lower expenses, as a percentage of sales, for 2014—compared to 2013.

Cost of product sold

Johnson & Johnson was able to improve its gross profit margins by concentrating on the sale of high margin products. The company also made cost reduction efforts across many businesses. As a percentage of sales, the company achieved a lower cost of products sold by 0.7% in 2014 to 30.6%—compared to 31.3% in 2013.

Selling, marketing, and administration expenses

Selling, marketing, and administration expenses include salaries, shipping and handling, marketing and advertising, and other operating expenses incurred by the company. With over 126,500 employees in over 275 Johnson & Johnson operating companies, the company has to incur huge salary costs.

It noticed an increase of 0.6% in selling, marketing, and administration expenses for 2014—compared to the year before. However, comparing the expenses as a percentage of sales, these expenses showed a dip of 1.1% at 29.5% in 2014—compared to 30.6% in 2013.

Research and development expenses

Johnson & Johnson is committed to investing in research and development. It aims to deliver innovative and high quality products. As a percentage of sales, the research and development expenses were nearly the same for 2014 and 2013. The company’s research and development focus shifted partially from the Medical Devices and Diagnostics segment to the Consumer Products segment.

Net earnings

As a percentage of sales, the company was able to improve its net earnings to 22% in 2014—compared to 19.4% in 2013. This was due to increased sales in the pharmaceutical business and a higher concentration on high margin products’ sales. Also, the company focused on cost reduction efforts across many businesses.

Other big pharma companies include Eli Lily and Company (LLY), Merck & Co. (MRK), and Novartis AG (NVS). Johnson & Johnson forms about 10.54% of the total assets of the Health Care Select Sector SPDR ETF (XLV).